Lecture Notes 1

Kevin R Foster, CCNY, ECO B2000

Fall 2013

Preliminary

We begin with

"Know Your Data" and "Show Your Data," to review some of

the very initial components necessary for data analysis.

You might want to

view online video 1; that covers similar basic information about measures of

the data center such as mean, median, and mode; also measures of the spread of

the data such as the standard deviation.

Those notes are the middle part of this lecture. In class we will skip right to Lecture 2,

where we apply these basic measures to learn about the PUMS dataset.

The

Challenge

Humans are bad at

statistics, we're just not wired to think this way. Despite or maybe, because of this,

statistical thinking is enormously powerful and it can quickly take over your

life. Once you begin thinking like a

statistician you will begin to see statistical applications to even your most

mundane activities.

Not only are humans

bad at statistics but statistics seem to interfere with essential human

feelings such as compassion.

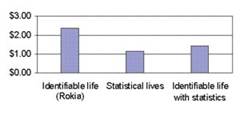

"A study by Small, Loewenstein,

and Slovic (2007)

gave people leaving a psychological experiment the

opportunity to contribute up to $5 of their earnings to Save the Children. In

one condition respondents were asked to donate money to feed an identified

victim, a seven-year-old African girl named Rokia. They contributed more than

twice the amount given by a second group asked to donate to the same organization

working to save millions of Africans from hunger (see Figure 2). A third group

was asked to donate to Rokia, but was also shown the larger statistical problem

(millions in need) shown to the second group. Unfortunately, coupling the

statistical realities with Rokias story significantly reduced the

contributions to Rokia.

A follow-up experiment by Small et

al. initially primed study participants either to feel (Describe your feelings

when you hear the word baby, and similar items) or to do simple arithmetic

calculations. Priming analytic thinking (calculation) reduced donations to the

identifiable victim (Rokia) relative to the feeling-based thinking prime. Yet

the two primes had no distinct effect on statistical victims, which is

symptomatic of the difficulty in generating feelings for such victims." (Paul Slovic, Psychic Numbing and Genocide,

November 2007, Psychological Science Agenda,

http://www.apa.org/science/psa/slovic.html)

Yet although we're

not naturally good at statistics, it is very important for us to get

better. Consider all of the people who

play the lottery or go to a casino, sacrificing their hard-earned money. (Statistics questions are often best illustrated

by gambling problems, in fact the science was pushed along by questions about

card games and dice games.)

Google, one of the

world's most highly-regarded companies, famously uses statistics to guide even

its smallest decisions:

A designer, Jamie Divine, had picked

out a blue that everyone on his team liked. But a product manager tested a

different color with users and found they were more likely to click on the

toolbar if it was painted a greener shade.

As trivial as color choices might

seem, clicks are a key part of Googles revenue stream, and anything that

enhances clicks means more money. Mr. Divines team resisted the greener hue,

so Ms. Mayer split the difference by choosing a shade halfway between those of

the two camps.

Her decision was diplomatic, but it

also amounted to relying on her gut rather than research. Since then, she said,

she has asked her team to test the 41 gradations between the competing blues to

see which ones consumers might prefer (Laura M Holson, "Putting a Bolder

Face on Google" New York Times, Feb 28, 2009).

Substantial

benefits arise once you learn stats.

Specifically, if so many people are bad at it then gaining a skill in

Statistics gives you a scarce ability and, since Adam Smith, economists have

known that scarcity brings value. (And

you might find it fun!)

Leonard Mlodinow,

in his book The Drunkard's Walk,

attributes the fact that we humans are bad at statistics as due to our need to

feel in control of our lives. We don't

like to acknowledge that so much of the world is genuinely random and

uncontrollable, that many of our successes and failures might be due to

chance. When statisticians watch sports games,

we don't believe sportscasters who discuss "that player just wanted it

more" or other un-observable factors; we just believe that one team or the

other got lucky.

As an example, suppose

we were to have 1000 people toss coins in the air those who get

"heads" earn a dollar, and the game is repeated 10 times. It is likely that at least one person would

flip "heads" all ten times.

That person might start to believe, "Hey, I'm a good heads-tosser,

I'm really good!" Somebody else is

likely to have tossed "tails" ten times in a row that person would

probably be feeling stupid. But both are

just lucky. And both have the same 50%

chance of making "heads" on the next toss. Einstein famously said that he didn't like to

believe that God played dice with the universe but many people look to the dice

to see how God plays them.

Of course we

struggle to exert control over our lives and hope that our particular choices

can determine outcomes. But, as we begin

to look at patterns of events due to many people's choices, then statistics

become more powerful and more widely applicable. Consider a financial market: each individual

trade may be the result of two people each analyzing the other's offers, trying

to figure out how hard to press for a bargain, working through reams of data

and making tons of calculations. But in

aggregate, financial markets move randomly if they did not then people could

make a lot of money exploiting the patterns.

Statistics help us both to see patterns in data that would otherwise see

random and also to figure out when the patterns we observe are due to random

chance. Statistics is an incredibly

powerful tool.

Economics is a

natural fit for statistical analysis since so much of our data is

quantitative. Econometrics is the

application of statistical analyses to economic problems. In the words of John Tukey, a legendary

pioneer, we believe in the importance of "quantitative knowledge a

belief that most of the key questions in our world sooner or later demand

answers to by how much? rather than

merely to in which direction?"

This class

In my experience,

too many statistics classes get off to a slow start because they build up

gradually and systematically. That might

not sound like a bad thing to you, but the problem is that you, the student,

get answers to questions that you haven't yet asked. It can be more helpful to jump right in and

then, as questions arise, to answer those at the appropriate time. So we'll spend a lot of time getting on the

computer and actually doing statistics.

So the class will

not always closely follow the textbook, particularly at the beginning. We will sometimes go in circles, first giving

a simple answer but then returning to the most important questions for more

study. The textbook proceeds gradually

and systematically so you should read that to ensure that you've nailed down

all of the details.

Statistics and

econometrics are ultimately used for persuasion. First we want to persuade ourselves whether

there is a relationship between some variables.

Next we want to persuade other people whether there is such a

relationship. Sometimes statistical

theory can become quite Platonic in insisting that there is some ideal

coefficient or relationship which can be discerned. In this class we will try to keep this sort

of discussion to a minimum while keeping the "persuasion" rationale

uppermost.

Step One:

Know Your Data

The first step in

any examination of data is to know that data where did it come from? Who collected it? What is the sample of? What is being measured? Sometimes you'll find people who don't even

know the units!

Economists often

get figures in various units: levels, changes, percent changes (growth), log

changes, annualized versions of each of those.

We need to be careful and keep the differences all straight.

Annualized Data

At the simplest

level, consider if some economic variable is reported to have changed by 100 in

a particular quarter. As we make

comparisons to previous changes, this is straightforward (was it more than 100

last quarter? Less?). But this has at

least two possible meanings only the footnotes or prior experience would tell

the difference. It could imply that the

actual change was 100, so if the item continued to change at that same rate

throughout the year, it would change by 400 after 4 quarters. Or it could imply that the actual change was

25 and if the item continued to change at that same rate it would be 100 after

4 quarters this is an annualized change.

Most GDP figures are annualized.

But you'd have to read the footnotes to make sure.

This distinction

holds for growth rates as well. But

annualizing growth rates is a bit more complicated than simply multiplying. (These are also distinct from year-on-year

changes.)

CPI changes are

usually reported as monthly changes (not annualized). GDP growth is usually annualized. So a 0.2% change in the month's CPI and a

2.4% growth in GDP are actually the same!

Any data report released by a government statistical agency should

carefully explain if any changes are annualized or "at an annual

rate."

Seasonal

adjustments are even more complicated, where growth rates might be reported as

relative to previous averages. We won't yet

get into that.

To annualize growth

rates, we start from the original data (for now assume it's quarterly): suppose

some economic series rose from 1000 in the first quarter to 1005 in the second

quarter. This is a 0.5% growth from

quarter to quarter (=0.005). To

annualize that growth rate, we ask what would be the total growth, if the

series continued to grow at that same rate for four quarters.

This would imply

that in the third quarter the level would be 1005*(1 + 0.005) =1005*(1.005) =

1000*(1.005)*(1.005) = 1000*(1.005)2; in the fourth quarter the

level would be 1000*(1.005) *(1.005)*(1.005) = 1000*(1.005)3; and in

the first quarter of next year the level would be 1000*(1.005) *(1.005)

*(1.005) *(1.005) = 1000*(1.005)4, which is a little more than 2%.

This would mean

that the annualized rate of growth (for an item reported quarterly) would be

the final value minus the beginning value, divided by the beginning value,

which is ![]() .

.

Generalized, this

means that quarterly growth is annualized by taking the single-quarter growth

rate, ![]() , and converting this to an annualized rate of

, and converting this to an annualized rate of ![]() .

.

If this were

monthly then the same sequence of logic would get us to insert a 12 instead of

a 4 in the preceding formula. If the

item is reported over ![]() time periods, then the

annualized rate is

time periods, then the

annualized rate is ![]() . (Daily rates could

be calculated over 250 business days or 360 "banker's days" or

365/366 calendar days per year.)

. (Daily rates could

be calculated over 250 business days or 360 "banker's days" or

365/366 calendar days per year.)

The year-on-year

growth rate is different. This looks

back at the level from one year ago and finds the growth rate relative to that

level.

Each method has its

weaknesses. Annualizing needs the assumption

that the growth could continue at that rate throughout the year not always

true (particularly in finance, where a stock could bounce by 1% in a day but it

is unlikely to be up by over 250% in a year there will be other large

drops). Year-on-year changes can give a

false impression of growth or decline after the change has stopped.

For example, if some

item the first quarter of last year was 50, then it jumped to 60 in the second

quarter, then stayed constant at 60 for the next two quarters, then the

year-on-year change would be calculated as 20% growth even after the series had

flattened.

Sometimes several

measures are reported, so that interested readers can get the whole story. For examples, go to the US Economics &

Statistics Administration, http://www.esa.doc.gov/, and read some of the

"Indicators" that are released.

For example, on

July 14, 2011, "The U.S. Census Bureau announced today that advance

estimates of U.S. retail and food services sales for June, adjusted for

seasonal variation and holiday and trading-day differences, but not for price

changes, were $387.8 billion, an increase of 0.1 percent (±0.5%) from the

previous month, and 8.1 percent (±0.7%) above June 2010." That tells you the level (not annualized),

the monthly (not annualized) growth, and the year-0n-year growth. The reader is to make her own inferences.

GDP estimates are

annualized, though, so we can read statements like this, from the BEA's July 29

release, "Current-dollar GDP ... increased 3.7 percent, or $136.0 billion,

in the second quarter to a level of $15,003.8 billion. " The figure, $15 trillion, is scaled to an annual

GDP figure; we wouldn't multiply by 4.

On the other hand, the monthly retail sales figures above are not multiplied by 12.

So if, for

instance, we wanted to know the fraction of GDP that is retail sales, we could NOT divide 387.8/15003.8 = 2.6%! Instead either multiply the retail sales

figure by 12 or divide the GDP

figure by 12. This would get 31%. More pertinently, if we hear that government stimulus

spending added $20 billion, we might want to try to figure out how much this

helped the economy. Again, dividing

20/15003.8 = 0.13% (13 bps) but this is wrong!

The $15tn is at an annual rate but the $20bn is not, so we've got to get

the units consistent. Either multiply 50

by 4 or divide 15,003.8 by 4. (This

mistake has been made by even very smart people!)

So don't make those

foolish mistakes and know your data. If

you have a sample, know what the sample is taken from. Often we use government data and just

casually assume that, since the producers are professionals, that it's exactly

what I want. But "what I want"

is not always "what is in the definition." Much government data (we'll be using some of

it for this class) is based on the Current Population Survey (CPS), which

represents the civilian non-institutional population. Since it's the main source of data on

unemployment rates, it makes good sense to exclude people in the military (who

have little choice about whether to go to work today) or in prison (again,

little choice). But you might forget

this, and wonder why there are so few soldiers in the data that you're working

with <forehead slap!>.

So know your

data. Even if you're using internal

company numbers, you've got to know what's being counted when are sales

booked? Warehouse numbers aren't usually

quite the same as accounting numbers.

Show the

Data

A hot field

currently is "Data Visualization."

This arises from two basic facts: 1. We're drowning in data; and 2.

Humans have good eyes.

We're drowning in

data because increasing computing power makes so much more available to

us. Companies can now consider giving

top executives a "dashboard" where, just like a driver can tell how

fast the car is travelling right now, the executive can see how much profit is

being made right now. Retailers have

automated scanners at the cash register and at the receiving bay doors; each

store can figure out what's selling.

The data piles up while

nobody's looking at it. An online store

might generate data on the thousands of clicks simultaneously occurring, but

it's probably just spooling onto some server's disk drive. It's just like spy agencies that harvest vast

amounts of communications (voice, emails, videos, pictures) but then can't

analyze them.

The hoped-for

solution is to use our fundamental capacities to see patterns; convert machine

data to visuals. Humans have good eyes;

we evolved to live in the East African plains, watching all around ourselves to

find prey or avoid danger. Modern people

read a lot but that takes just a small fraction of the eye's nerves; the rest

are peripheral vision. We want to make

full use of our input devices.

But putting data

into visual form is really tough to do well!

The textbook has many examples to help you make better charts. Read Chapter 3 carefully. The homework will ask you to try your hand at

it.

Histograms

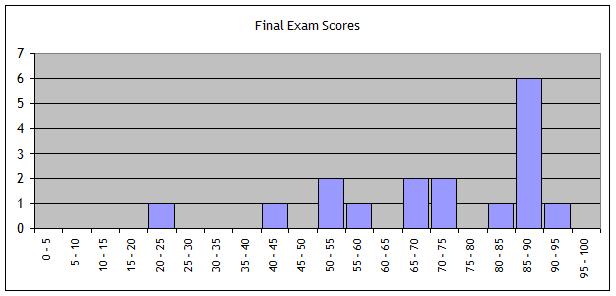

You might have

forgotten about histograms. A histogram

shows the number (or fraction) of outcomes which fall into a particular

bin. For example, here is a histogram of

scores on the final exam for a class that I taught:

This histogram

shows a great deal of information; more than just a single number could

tell. (Although this histogram, with so

many one- or two-step sizes, could be made much better.)

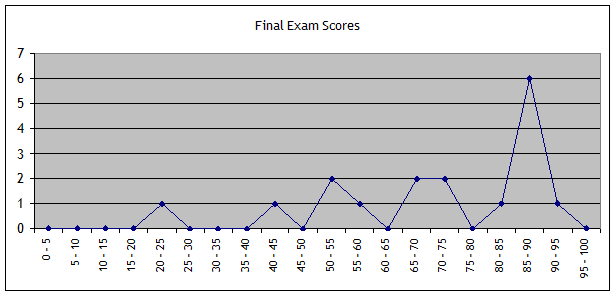

Often a histogram

is presented, as above, with blocks but it can just as easily be connected

lines, like this:

The information in

the two charts is identical.

Histograms are a

good way of showing how the data vary around the middle. This information about the spread of outcomes

around the center is very important to most human decisions we usually don't

like risk.

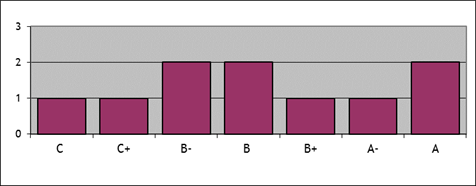

Note that the

choice of horizontal scaling or the number of bins can be fraught.

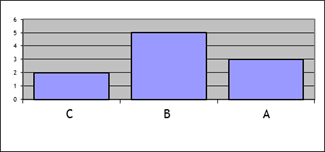

For example

consider a histogram of a student's grades.

If we leave in the A- and B+ grades, we would show a histogram like

this:

whereas by

collapsing together the grades into A, B, and C categories we would get

something more intelligible, like this:

.

.

This shows the

central tendency much better the student has gotten many B grades and

slightly more A grades than C grades.

The previous histogram had too many categories so it was difficult to

see a pattern.

Basic

Concepts: Find the Center of the Data

You need to know

how to calculate an average (mean), median, and mode. After that, we will move on to how to

calculate measures of the spread of data around the middle, its variation.

Average

There are a few

basic calculations that we start with.

You need to be able to calculate an average, sometimes called the mean.

The average of some

values, X, when there are N of them, is the sum of each of the values (index

them by i) divided by N, so the average of X, sometimes denoted ![]() , is

, is

![]() .

.

The average value

of a sample is NOT NECESSARILY REPRESENTATIVE of what actually happens. There are many jokes about the average

statistician who has 2.3 kids. If there

are 100 employees at a company, one of whom gets a $100,000 bonus, then the

average bonus was $1000 but 99 out of 100 employees didn't get anything.

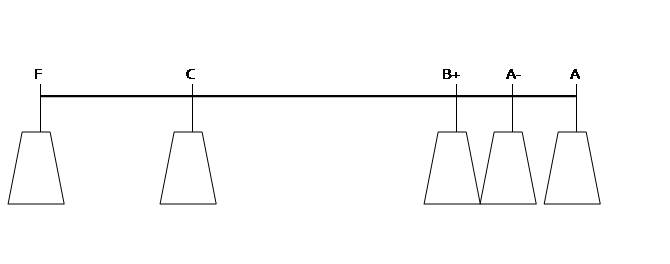

A common graphical

interpretation of an average value is to interpret the values as lengths along

which weights are hung on a see-saw. The

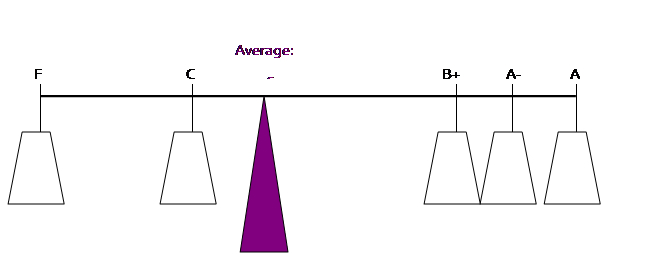

average value is where a fulcrum would just balance the weights. Suppose a student is calculating her

GPA. She has an A (worth 4.0), an A- (3.67),

a B+ (3.33), a C (2.0) and one F (0) [she's having troubles!]. We could picture these as weights:

The weights

"balance" at the average point (where (0 + 2 + 3.33 + 3.67 + 4)/5 =

2.6):

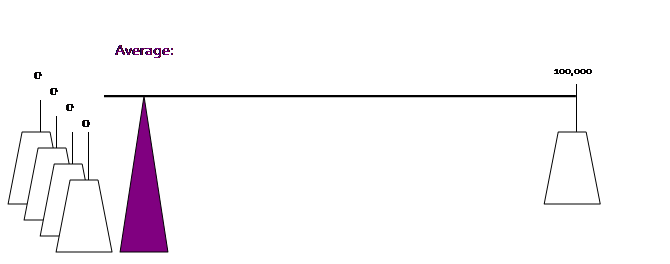

So the

"bonus" example would look like this, with one person getting

$100,000 while the other 99 get nothing:

Where there are

actually 99 weights at "zero."

But even one person with such a long moment arm can still shift the

center of gravity away.

Bottom Line: The average is often a good way of understanding what

happens to people within some group. But

it is not always a good way.

Sometimes we

calculate a weighted average using some set of weights, w, so

![]() , where

, where ![]() .

.

Your GPA, for

example, weights the grades by the credits in the course. Suppose you get a B grade (a 3.0 grade) in a

4-credit course and an A- grade (a 3.67 grade) in a 3-credit course; you'd

calculate GPA by multiplying the grade times the credit, summing this, then

dividing by the total credits:

![]() .

.

So in this example

the weights are ![]() .

.

When an average is

projected forward it is sometimes called the "Expected Value" where

it is the average value of the predictions (where outcomes with a greater

likelihood get greater weight). This

nomenclature causes even more problems since, again, the "Expected

Value" is NOT NECESSARILY REPRESENTATIVE of what actually happens.

To simplify some

models of Climate Change, if there is a 10% chance of a 10° increase in

temperature and a 90% chance of no change, then the calculated Expected Value

is a 1° change but, again, this value does not actually occur in any of the

model forecasts.

For those of you who have taken

calculus, you might find these formulas reminiscent of integrals good for

you! But we won't cover that now. But if you think of the integral as being

just an extreme form o f a summation, then the formula has the same format.

Median

The median is

another measure of what happens to a 'typical' person in a group; like the mean

it has its limitations. The median is

the value that occurs in the 50th percentile, to the person (or

occurrence) exactly in the middle. If

there are an odd number of outcomes, otherwise it is between the two middle

ones.

In the bonus

example above, where one person out of 100 gets a $100,000 bonus, the median

bonus is $0. The two statistics

combined, that the average is $1000 but the median is zero, can provide a

better understanding of what is happening.

(Of course, in this very simple case, it is easiest to just say that one

person got a big bonus and everyone else got nothing. But there may be other cases that aren't

quite so extreme but still are skewed.)

Mode

The mode is the

most common outcome; often there may be more than one. If there were a slightly more complicated

payroll case, where 49 of the employees got zero bonus, 47 got $1000, and four

got $13,250 each, the mean is the same at $1,000, the median is now equal to

the mean [review those calculations for yourself!], but the mode is zero. So that gives us additional information

beyond the mean or median.

Spread

around the center

Data distributions

differ not only in the location of their center but also in how much spread or

variation there is around that center point.

For example a new drug might promise an average of 25% better results than

its competitor, but does this mean that 25% of patients improved by 100%, or

does this mean that everybody got 25% better?

It's not clear from just the central tendency. But if you're the one who's sick, you want to

know.

This is a familiar

concept in economics where we commonly assume that investors make a tradeoff

between risk and return. Two hedge funds

might both have a record of 10% returns, but a record of 9.5%, 10%, and 10.5%

is very different from a record of 0%, 10%, and 20%. (Actually a record of always winning, no

matter what, distinguished Bernie Madoff's fund...)

You might think to

just take the average difference of how far observations are from the average,

but this won't work.

There's an old joke

about the tenant who complains to the super that in winter his apartment is 50°

and in summer is 90° -- and the super responds, "Why are you

complaining? The apartment is a

comfortable 70° on average!" (So the tenant replies "I'm complaining because I have a squared

error loss function!" If you thought that was funny, you're

a stats geek already!)

The average

deviation from the average is always zero.

Write out the formulas to see.

The average of some

N values, ![]() , is given by

, is given by ![]() .

.

So what is the

average deviation from the average, ![]() ?

?

We know that ![]() and, since

and, since ![]() is the same for every observation,

is the same for every observation, ![]() , if we substitute back from the definition of

, if we substitute back from the definition of ![]() . So

. So ![]() . We can't re-use the

average. So we want to find some useful,

sensible function [or functions],

. We can't re-use the

average. So we want to find some useful,

sensible function [or functions], ![]() , such that

, such that ![]() .

.

Standard Deviation

The most commonly

reported measure of spread around the center is the standard deviation. This looks complicated since it squares the

deviations and then takes the square root, but is actually quite generally

useful.

The formula for the

standard deviation is a bit more complicated:

.

.

Before you start to

panic, let's go through it slowly. First

we want to see how far each observation is from the mean,

![]() .

.

If we were to just

sum up these terms, we'd get nothing the positive errors and negative errors

would cancel out.

So we square the deviations

and get

![]() ,

,

and then just

divide by n to find the average squared error, which is known as the variance,

which is

![]() .

.

The standard

deviation is the square root of the variance; ![]()

.

.

Of course you're

asking why we bother to square all of the parts inside the summation, if we're

only going to take the square root afterwards.

It's worthwhile to understand the rationale since similar questions will

re-occur. The point of the squared

errors is that they don't cancel out.

The variance can be thought of as the average size of the squared

distances from the mean. Then the square

root makes this into sensible units.

The variance and

standard deviation of the population divides by N; the variance and standard

deviation of a sample divide by (N 1).

This is referred to as a "degrees of freedom correction,"

referring to the fact that a sample, after calculating the mean, has lost one

"degree of freedom," so the standard deviation has only (N df)

remaining. You could worry about that

difference or you could note that, for most datasets with huge N (like the ATUS

with almost 100,000), the difference is too tiny to worry about.

Our notation

generally uses Greek letters to denote population values and English letters

for sample values, so we have

![]() and

and

.

.

As you learn more statistics

you will see that the standard deviation appears quite often. Hopefully you will begin to get used to it.

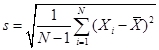

We could look at

other functions of the distance of the data from the central measure, ![]() , such that

, such that ![]() -- for example, the

mean of the absolute value,

-- for example, the

mean of the absolute value, ![]() . By recalling the

graphs of these two functions you can begin to appreciate how they differ:

. By recalling the

graphs of these two functions you can begin to appreciate how they differ:

So that squaring

the difference counts large deviations very much worse than small deviations,

whereas an absolute deviation does not.

So if you're trying to hit a central target, it might well make sense

that wider and wider misses should be penalized worse, while tiny misses should

be hardly counted.

There is a relationship

between the distance measure selected and the central parameter. For example, suppose I want to find some

number, Z, that minimizes a measure of distance of this number, Z, from each

observations. So I want to minimize ![]() . If we were to use

the absolute value function then setting Z to the median would minimize the

distance. If we use instead the squared

function then setting Z to the average would minimize the distance. So there is an important connection between

the average and the standard deviation, just as there is a connection between

the median and the absolute deviation. (Can you think of what distance measure is connected with the mode?)

. If we were to use

the absolute value function then setting Z to the median would minimize the

distance. If we use instead the squared

function then setting Z to the average would minimize the distance. So there is an important connection between

the average and the standard deviation, just as there is a connection between

the median and the absolute deviation. (Can you think of what distance measure is connected with the mode?)

If you know

calculus, you will understand why, in the age before computer calculations,

statisticians preferred the squared difference to the absolute value of the

difference. If we look for an estimator

that will minimize that distance, then in general in order to minimize

something we will take its derivative.

But the derivative of the absolute value is undefined at zero, while the

squared distance has a well-defined derivative.

Sometimes you will

see other measures of variation; the textbook goes through these

comprehensively. Note that the

Coefficient of Variation, ![]() , is the reciprocal of the signal-to-noise ratio. This is an important measure when there is no

natural or physical measure, for example a Likert scale. If you ask people to rate beers on a scale of

1-10 and find that consumers prefer Stone's Ruination Ale to Budweiser by 2

points, you have no idea whether 2 is a big or a small difference unless you

know how much variation there was in the data (i.e. the standard

deviation). On the other hand, if

Ruination costs $2 more than Bud, you can interpret that even without a

standard deviation.

, is the reciprocal of the signal-to-noise ratio. This is an important measure when there is no

natural or physical measure, for example a Likert scale. If you ask people to rate beers on a scale of

1-10 and find that consumers prefer Stone's Ruination Ale to Budweiser by 2

points, you have no idea whether 2 is a big or a small difference unless you

know how much variation there was in the data (i.e. the standard

deviation). On the other hand, if

Ruination costs $2 more than Bud, you can interpret that even without a

standard deviation.

In finance, this

signal/noise ratio is referred to as the Sharpe Ratio, ![]() , where

, where ![]() are the average

returns on a portfolio and

are the average

returns on a portfolio and ![]() is the risk-free rate;

the Sharpe Ratio tells the returns relative to risk.

is the risk-free rate;

the Sharpe Ratio tells the returns relative to risk.

Sometimes we will

use "Standardized Data," usually denoted as ![]() , where the mean is subtracted and then we divide by the

standard deviation, so

, where the mean is subtracted and then we divide by the

standard deviation, so ![]() . This is

interpretable as measuring how many standard deviations from the mean is any

particular observation. This allows us

to abstract from the particular units of the data (meters or feet; Celsius or

Fahrenheit; whatever) and just think of them as generic numbers.

. This is

interpretable as measuring how many standard deviations from the mean is any

particular observation. This allows us

to abstract from the particular units of the data (meters or feet; Celsius or

Fahrenheit; whatever) and just think of them as generic numbers.

Now Do

It!

We'll use data from

the Census PUMS, on just people in New York City, to begin actually doing

statistics using the analysis program called SPSS. There are further lecture notes on each of

those topics. Read those carefully;

you'll need them to do the homework assignment.

Overview

of PUMS

We will use data

from the Census Bureau's "Public

Use Microdata Survey," or PUMS.

This is collected in the American Community Survey; just about every ten

years since 1790 the Census has made a complete enumeration of the US

population as required by the Constitution.

We will work on

this data using SPSS. Later I give an

overview of the basics of how to use that program (there are also videos

online).

The dataset, which

is only just information on respondents in the five boroughs of New York City,

is ready to use in SPSS. Download it

from the class web page (or InYourClass page) onto your computer desktop. It is zipped so you must unzip it. Remember that if you're in the computer lab,

just double-clicking on the SPSS file may not automatically start up SPSS;

you'll get some error code. So use the

Start bar to find SPSS and start the program that way. Then open up your dataset once the program

has loaded.

SPSS has two views

of the dataset: Variable View and Data View.

Usually we use the Variable View; this lists all of the different

information available.

The dataset has

information on 315,771 people in 133,043 households. If there is a family living together in an apartment,

say a mother and two kids, then each person has a row of data telling about

him/her (age, gender, education, etc) but only the head of household (in this

case, the mother) would have information about the household (how much is spent

on rent, utilities, etc.). Depending on

what analysis is to be made, the researcher might want to look at all the

people or all of the households (or subsets of either). If you look at the "Data View" tab

you can see the difference. (Note that

the "head of household" is defined by the person interviewed so it

could be the man or woman, if there are both.)

The first column of

data is a serial number, shared by each person in the household. After that you can see that some variables

are filled in for every person (age, female, education levels) but other

variables are only filled in for one person in the household (has_kids,

kids_under6, kids_under17).

Many of the

variables are coded as "dummy variables" which simply means that they

have a value of zero or one a one codes as "yes, true" and a zero

is "no, false." So one of the

first dummy variables is named "female" and women have a 1 while men

have a 0. (According to the government,

everybody must be one or the other.)

There are variables

coding people's race/ethnicity, if they were born in the US or a foreign

country, how much schooling they have, if they are single or married, if

they're a veteran (and when they served), even what borough they live in and

how they commute to work. There is some

greater detail about ancestry (where people can write in detail about their

background). There is information about

their incomes. For the household there

is information about the dwelling including when built, number of various

rooms, how recently they moved, amount paid for fuel, mortgage/rent and

fraction of monthly household income that is spent on mortgage/rent, etc.

Basics

of government race/ethnicity classification

The US government

asks questions about people's race and ethnicity. These categories are social constructs, which

is a fancy way of pointing out that they are not based on hard science but on

people's own views of themselves (influenced by how people think that other

people think of them...). Currently the

standard classification asks people separately about their "race" and

"ethnicity" where people can pick labels from each category in any

combination.

The

"race" categories that are listed on the government's form are: "White alone," "Black or African-American alone," "American Indian alone," "Alaska

Native alone," "American Indian and Alaska Native tribes specified;

or American Indian or Alaska native, not specified and no other

race," "Asian alone," "Native Hawaiian and other Pacific

Islander alone," "Some other

race alone," or "Two or more

major race groups." (Then the

supplemental race categories offer more detail.)

These are a

peculiar combination of very general (well over 40% of the world's population

is "Asian") and very specific ("Alaska Native alone")

representing a peculiar history of popular attitudes in the US. Only in the 2000 Census did they start to

classify people in mixed races. If you

were to go back to historical US Censuses from more than a century ago, you

would find that the category "race" included separate entries for

Irish and French and various other nationalities. Stephen J Gould has a fascinating book, The Mismeasure of Man, discussing how

early scientific classifications of humans tried to "prove" which

nationalities/races/groups were the smartest.

Note that "Hispanic"

is not "race" but rather ethnicity (includes various other labels

such as Spanish, Latino, etc.). So a

respondent could choose "Hispanic" and any race category some

choose "White," some choose "Black," some might be combined

with any other of those complicated racial categories.

What that means,

specifically for us reporting statistics on a dataset like this, is that we can

easily find that, of the 315,771 people in the PUMS dataset who live in the

five boroughs of New York City, 48.2%

report their race as "White alone" and 24.2% as "Black

alone," 12.3% report as "Asian alone," 12.7% report "some

other race alone," 2.2% report multiple races, and less than 1% report any

Native American category. Then 24.1%

classify their ethnicity as Hispanic.

Can we just take the 48.2% White, subtract the 24.1% Hispanic to say

that 24.1% are "non-Hispanic White" (a category commonly used in

other government classifications)?

NO! Because that assumes that all

of the people who self-classified as Hispanic were also self-classified as

"White only" which is not true.

We would have to create a new variable for non-Hispanic White to find

that proportion. (Below I'll explain how

to do this with SPSS.)

The Census Bureau

gives more information here, http://www.census.gov/newsroom/minority_links/minority_links.html

All of these racial

categories makes some people uneasy: is the government encouraging racism by

recognizing these classifications? Some

other governments choose not to collect race data. But that doesn't mean that there are no

differences, only that the government doesn't choose to measure any of these

differences. In the US, government

agencies such as the Census and BLS don't generally collect data on religion

(except, for historical reasons, Judaism, sometimes considered a race or

ethnicity none of this makes any logical sense!).

About

SPSS

SPSS is a popular

and widely-used statistical program. It

is powerful but not too overwhelming for a beginner. SPSS is a bit harder than Excel but gives you

a much wider menu of statistical analysis.

You don't have to write computer programs like some of the others you

can just use drop-down menus and point and click.

Why learn this

particular program? You should not be

monolingual in statistical analysis, it is always useful to learn more

programs. The simplest is Excel, which

is very widely used but has a number of limitations mainly that, in order to

make it easy for ordinary people to use, they made it tough for power

users. SPSS is the next step: more

powerful but also a bit more difficult.

Next is Stata and SAS, which are a bit more powerful but also tougher to

use. Matlab is great but requires

writing programs of computer code. R is

an open-source version (we'll use that a little for this class) that is used by

many researchers but it requires some work to learn. Python is necessary if you're going to become

a real data analyst. The college has

SPSS, SAS, and Matlab freely available in all of the computer labs.

You might be

tempted to just use Excel; resist! Excel

doesn't do many of the more complex statistical analyses that we'll be learning

later in the course. Make the investment

to learn a better program; it has a very good cost/benefit ratio.

The

Absolute Beginning

Start up SPSS. On any of the computers in the Economics lab

(6/150) double-click on the "SPSS" logo on the desktop to start up

the program. In other computer labs you

might have to do a bit more hunting to find SPSS (if there's no link on the

desktop, then click the "Start" button in the lower left-hand corner,

and look at the list of "Programs" to find SPSS).

Sometimes double-clicking on a file that

is associated with SPSS doesn't

work! Especially if it's zipped. Same if you try to download a file and

automatically start up SPSS. So start

SPSS from the Start bar or desktop icon.

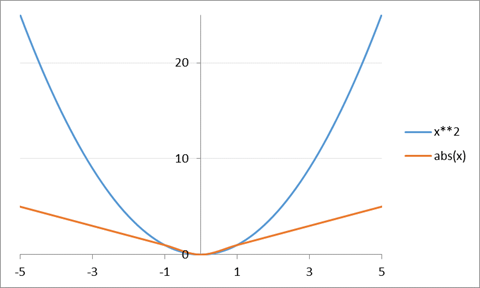

SPSS usually brings

up a screen like the one below asking "What

would you like to do?"

which offers some shortcuts. Just

"Cancel" this screen if it appears (later, as you get more familiar

with the program, you might find those shortcuts more useful).

Load a

SPSS Dataset

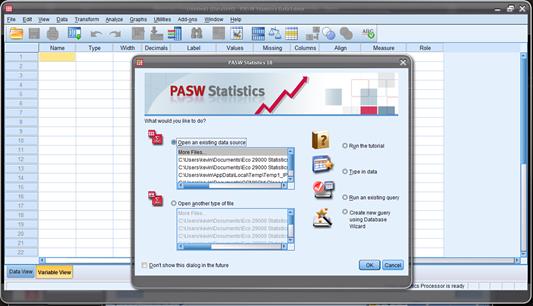

When SPSS starts,

you will be in the "SPSS Data

Editor" which looks like this.

![]()

Click on "File" then choose "Open"

then "Data

"

[not "File/Open Database"

that's different].

To open the ATUS

data, download it from the class webpage onto your computer desktop. Start SPSS.

Then "File \ Open \ Data..."

and find "ATUS_2003-09.sav".

(Many datasets are zipped, you first unzip it, then load it.)

SPSS has two tabs

(at the bottom left, in the yellow circle above) to change the way you view

your data. The "Data View" tab

shows the data the way it would look if it were on an Excel sheet. The "Variable View" tab shows more

information on the particular variable most importantly, the "name",

"label",

and "values". The Name

is how SPSS refers to the variable in its menus these names tend to be

inscrutable but you can think of them as nicknames. The Label

gives more details, so use the mouse to expand that column so that you can read

more. Then values tells you useful information about how the variable is

coded.

Save

your Work!

After you've made

changes, you don't want to lose them and have to re-do them. So save your dataset! ("File"

then "Save") You might want to give it a new name every so

often, so that you can easily revert back to an old version if you really screw

up on some day.

The computers in

the lab wipe the memory clean when you log off so back up your data. Either online (email it to yourself or upload

to Google Drive or iCloud or Blackboard) or use a USB drive. Also, figure out how to "zip" your

files (right-click on the data file) to save yourself some hours of up/download

time

Getting

Basic Statistics

From either the

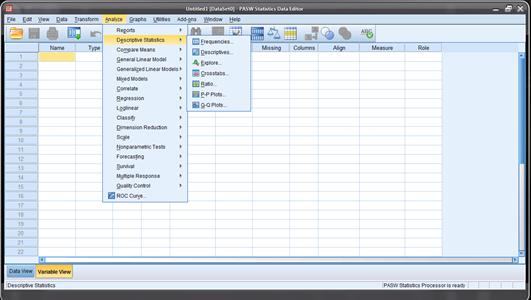

"Data View" or "Variable View" tab, click "Analyze"

then "Descriptive

Statistics" then "Descriptives":

This will bring up

a dialog box asking you which variables you want to get Descriptive Statistics

on.

Click on the

variable you want. Then click the arrow

button in the center box, which will move the variables into the column labeled

"Variable(s)". If you make a mistake and move the wrong

variable, just highlight it in the "Variable(s)" column and use

the arrow to move it back to the left.

Then click "OK"

and let the computer work.

If you want a bunch

that are all together in the list, click on the first variable that you want,

then hold down the "Shift" key and click on the last variable --

this highlights them all. If you want a

bunch that are separated, hold down the "Ctrl"

key and click on the ones you want.

Later, once you're

feeling confident, click on "Options" to see what's there.

Create

New Variables, like Age-squared or Interaction Age*Dummy, or take logs or

whatever

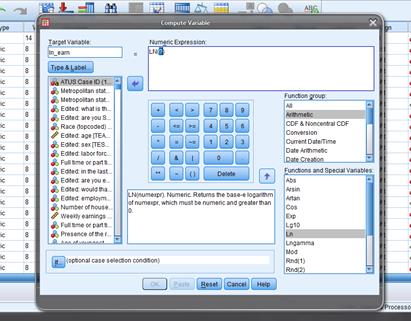

We often create new

variables. One common transformation is

taking the log. This is a common

procedure to cut down the noise and help to examine growth trends. Click on "Transform" and then "Compute

". This will bring up a dialog box labeled

"Compute Variable".

Type in the new

variable name (whatever you want, just remember it!) under "Target Variable". (You can click

'Type & Label" if you

want to enter more info that can remind yourself later.) For example we'll find the log (natural log)

of weekly earnings.

Under "Target Variable" type in the new name,

"ln_earn" or whatever and then in "Numeric Expression" you tell it what

this new variable is. You can make any

complicated or convoluted functions that are necessary for particular analyses;

for now find the "Function Group"

to click on "Arithmetic" and

then in the "Functions and Special

Variables" list below find "Ln". Double-click it and see that SPSS puts it up

into the "Numeric Expression"

box with a (?) in the argument. Double-click on the variable, weekly earnings

(TRERNWA), that you want to use

and then hit "OK".

You'll get a bunch

of errors where the program complains about trying to find the log of zero, but

it still does what you need. For wages,

where many people have wage=0, we often use lnwage = ln(wage + 1) which

eliminates the problem of ln(0) that returns an error; for most other people

the distinction between ln(1000) and ln(1001) is tiny. You can go back and re-do your variable if

you're feeling a need to be tidy.

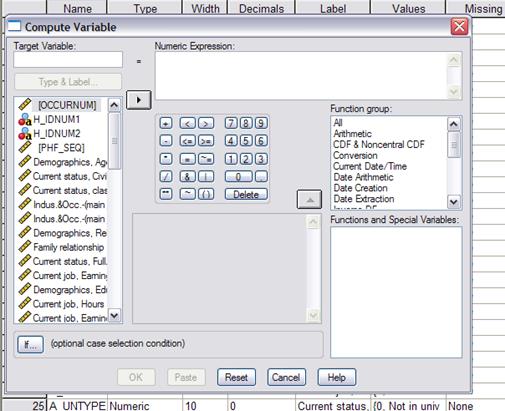

We often recode

using logical (Boolean) algebra, so for example to make a variable

"Hispanic" you'd type "Hispanic"

into the Target Variable, then click the "(

)" button (see the yellow circle in the screenshot below) to get a

parenthesis, double-click the variable that codes ethnicity so as to get PEHSPNON in the "Numeric Expression" and then add

"=1" to finish, so

getting a relationship that Hispanic is defined as: (PEHSPNON = 1).

SPSS understands that whenever that relation is true, it will put in a

1; where false it will put in a 0.

There are other

logical buttons (also in the yellow circle above) for putting together various

logical statements. The line up and

down, |, represents the logical

"OR"; the tilde, ~, is

logical "NOT".

If you wanted to

create a variable for those who report themselves as African-American and

Hispanic, you'd create the expression (AfricanAmerican

= 1) & (Hispanic = 1).

If we want more

combinations of variables then we create those.

Usually a statistical analysis spends a lot of time doing this sort of

housekeeping dull but necessary.

Re-Coding

complicated variables (like race, education, etc) from initial data

Often we have more

complicated variables so we need to be careful in considering the "Values" labels. For instance in the ATUS, as you look at the

"Variable View" of

your dataset, one of the first variables in the dataset has the name "PEEDUCA", which is short for

"PErson EDUCation Achieved" the person's education level. But the coding is strange: under "Values" you should see a box with

"

" in it click on

that to see the whole list of values and what they mean. You'll see that a "39" means that the person

graduated high school; a "43"

means that they have a Bachelor's degree.

Without that "Values"

information you'd have no way to know that.

It also means that you must do a bit of work re-coding variables before

you work with the data. The variable

"TEAGE" (which is the

person's age) has numbers like 35, 48, 19 just what you'd expect. These values have a natural interpretation;

you don't need a codebook for this one!

The variable "TESEX"

tells whether the person is male or female but it doesn't use text, it just

lists either the number 1 or 2. We could

guess that one of those is male and the other female, but we'd have to go back

to "Variable View" to

look at "Values" for

"TESEX" to find that a

1 indicates a male and a 2 indicates female.

Start with "TESEX" to create, instead, a

dummy variable (that takes a value of just zero or one) called "female" that is equal to one if

the person is female and zero if not. To

do this, click "Transform"

then "Compute

" which

will bring up a dialog box. The "Target Variable" is the new variable

you are creating; for this case, type in "female". The "Numeric

Expression" allows considerable freedom in transforming

variables. For this case, we will only

need a logical expression: "TESEX

= 2". You can either type in

the variable name, "TESEX",

or find the variable name in the list on the left of the dialog box and click

the arrow to insert the name.

Later you might

encounter cases where you want more complicated dummy variables and want to use

logical relations "and" "or" "not" (the symbols

"&", "|", "~") or the ">="

or multiplication or division. But in

this case, we just need "TESEX = 2"

which SPSS interprets as telling it to set a value of 1 in each case where that

logical expression is true, and a value of zero in each case where that

expression is false. If you go to "Data View" and scroll over (new

variables are all the way on the right) you can check that it looks right.

Next we'll create

the racial variables. We'll create dummy

variables for "white", "African-American", "American

Indian/Inuit/Hawaiian/Pacific Islander", and "Asian." We'll lump together the people who give

multiple identities with those who give a single one (this is standard in much

empirical work, although it is evolving rapidly).

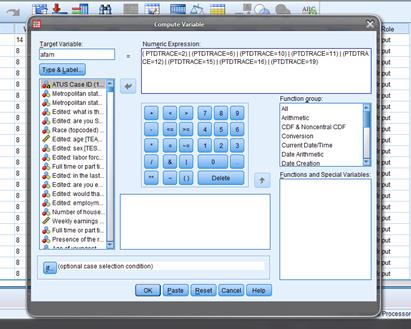

So "Tranform/Compute

" and label

"Target

Variable" as "white" with "Numeric

Expression" "PTDTRACE=1". Then "afam" is "( PTDTRACE=2)

| (PTDTRACE=6) | (PTDTRACE=10) | (PTDTRACE=11) | (PTDTRACE=12) | (PTDTRACE=15)

| (PTDTRACE=16) | (PTDTRACE=19)" note the parentheses and the

"or" symbol. "Asian"

is "(

PTDTRACE=4) | (PTDTRACE=8)".

"Amindian"

is "(

PTDTRACE=3) | (PTDTRACE=5) | (PTDTRACE=7) | (PTDTRACE=9) | (PTDTRACE=13) | (PTDTRACE=14)

| (PTDTRACE=17) | (PTDTRACE=18) | (PTDTRACE=20) | (PTDTRACE=21)". Many of these codings of multiple races could

be argued you can make changes if you wish. One reason to learn to do this

yourself is to find out where minor changes could make a difference in the

conclusions. Do you think that, say,

average wages are different for these racial categories?

We create a dummy

variable for "Hispanic". Again

use "Transform/Compute

"

and label "Target Variable" as "Hispanic"

with "Numeric

Expression" of "(PEHSPNON

= 1)".

Earlier I mentioned

that we can't find non-Hispanic whites by taking the total number of

"white only" and subtracting "Hispanic" but how can we find

the actual number of non-Hispanic whites?

On the drop-down menu of SPSS find "Transform" then

"Compute Variable" then in the dialog box, give the new variable (it

calls it the "Target Variable") a name (e.g.

"nonHispWhite") and a Numeric Expression, for example here " (RAC1P

= 1) & (HISP = 1) ". The first

expression evaluates, for each case, whether the variable, "RAC1P"

which is the variable coding race, has a value of 1 (which corresponds to the

label "White alone"). If it

equals 1 then the expression is True, which is coded as 1; if RAC1P does not

equal 1 then the expression is False, coded as zero. The second expression evaluates if

"HISP" equals 1 or not. The

"&" sign in the middle evaluates if both expressions are true or

not. When we run this classification, we

find that 38.9% are non-Hispanic white, a big difference from the previous 24%!

Create dummy

variables for education: a dummy for no high school "ed_nohs", for high school but no

further "ed_hs",

for some college "ed_scol", for a bachelor's degree "ed_coll",

and for more than a 4-year degree "ed_adv". "Transform/Compute

", set

"Target

Variable" as "ed_nohs" and "Numeric

Expression" as " PEEDUCA

<39". Then "ed_hs"

is " PEEDUCA =39";

"ed_scol"

is "( PEEDUCA >39)&( PEEDUCA <43)"; "ed_coll"

is " PEEDUCA =43";

"ed_adv"

is " PEEDUCA

>43". Sometimes we

distinguish various sorts of "some college" between people who got an

Associate's degree versus those who took classes but never got any degree.

Then run

"Descriptive Statistics" to make sure everything looks right your

dummy variables should have min=0 and max=1, for example!

Data

Sub-Sets

Often we want to

compare groups of people within the dataset to each other, for example looking

at whether men or women get paid more or commute different or whatever. Comparisons are often more useful than just

raw numbers because comparisons allow us to begin to judge which differences

are substantial.

Do this with "Data" then "Select Cases..." to get a screen

like this:

Usually we select

cases "If condition is satisfied"

so choose that, then click on "If..."

This brings up a

dialog box that looks like the "Compute Variable" box from

above. If we have already created a

dummy variable that has values of only zeroes and ones then you can just put

that into the "Select Cases" box.

If you want a more complicated set then you can build it up using the

logical notation that we discussed above.

So suppose you want to look at just the subgroup of women between the

ages of 18-35. Then we would enter

"(TESEX = 2) & (TEAGE > 18)

& (TEAGE <= 35)".

Click "Continue". Make

sure the output is "Filter out unselected cases" (you don't usually

want to permanently delete the unselected cases!). Then all of your subsequent analyses will be

done for just that subgroup.

Often an analysis

will be more concerned with whether a particular item is done rather than how

long for example, when looking at working, whether a person has a second job

(so time spent working second job is greater than zero) is probably more

important than just how long they spent working at this second job. So often the "if..." statement will be of the form, "X > 0" for whatever variable,

X, you're considering.

Later on, we will

learn some more sophisticated ways of doing it but for now this is

straightforward and clear. It will allow

you to do the homework assignment.

Example

I will do an

example to make this a bit clearer. We

will look at the difference in how much time male and female college students

spend watching TV. (I hope that for you

the answer, how much time is wasted on TV, is "zero"!)

Open the ATUS

2003-2009 dataset.

First use "Transform \ Compute ..." to

create a new variable, tv_time, which we set equal to the sum of T120303,

watching non-religious TV, and T120304, watching religious TV. (Should we include T120308, playing computer

games?)

Use "Transform

\ Compute ..." to create another variable, educ_time, which is the

sum of time spent doing things relevant to education, T060101 + T060102 +

T060103 + T060104 + T060199 + T060301 + T060302 + T060303 + T060399. (Time spent in class and time spent doing

homework, mainly.)

I'll also create

"ratio_TV_study" that is the ratio of TV_time to educ_time.

Run "Analyze \ Descriptive Statistics \

Descriptives ..." to check that these seem sensible:

|

Descriptive Statistics |

|||||

|

|

N |

Minimum |

Maximum |

Mean |

Std. Deviation |

|

tv_time |

98778 |

.00 |

1417.00 |

165.2058 |

168.33963 |

|

educ_time |

98778 |

.00 |

1090.00 |

16.3008 |

79.47292 |

|

ratio_TV_study |

5974 |

.00 |

120.00 |

1.0450 |

3.00829 |

|

Valid

N (listwise) |

5974 |

|

|

|

|

Note that the

average for "educ_time" is low because most non-students will report

zero time spent studying. All of those

zero values returned errors when computing the ratio, so this has only 5974 reports

of people with more than zero time studying.

Use "Data \

Select Cases ... " to select only college students (those for whom the 13th

variable, TESCHLVL, is equal to 2).

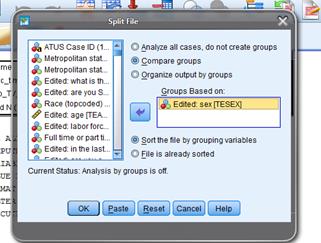

Now to compare men

and women I will use "Data \ Split

File ... " to split into two groups and compare them the program

will do this automatically for all subsequent analysis.

This Split File

screen is:

Now when I run the

same "Descriptives" as before, this time I get the output subdivided:

|

Descriptive

Statistics |

||||||

|

Edited: sex |

N |

Minimum |

Maximum |

Mean |

Std.

Deviation |

|

|

= "Male" |

tv_time |

2018 |

.00 |

860.00 |

127.1665 |

138.93259 |

|

educ_time |

2018 |

.00 |

1051.00 |

112.6056 |

186.01012 |

|

|

ratio_TV_study |

784 |

.00 |

75.00 |

.8390 |

3.02939 |

|

|

Valid N (listwise) |

784 |

|

|

|

|

|

|

=

"Female" |

tv_time |

3581 |

.00 |

1100.00 |

111.4739 |

124.86338 |

|

educ_time |

3581 |

.00 |

1090.00 |

104.8176 |

173.84758 |

|

|

ratio_TV_study |

1450 |

.00 |

120.00 |

.9117 |

4.04470 |

|

|

Valid N (listwise) |

1450 |

|

|

|

|

|

This shows that

male college students watch an average of 127 minutes of TV per day and devote

an average of 113 minutes to school; females watch 111 minutes of TV and devote

105 minutes to their studies. Men watch

more TV but also spend a bit more time on school so the average ratio of time

spent watching TV to time spent on school is .91 for women and .84 for men.

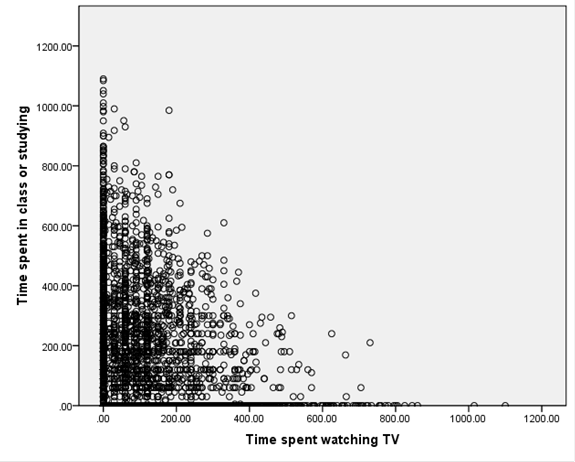

Finally I'll show a

graph,

Note that there are

quite a number of respondents who spent zero time studying or zero time

watching TV. We would expect a downward

relation since it is like a budget set: the more time is spent watching TV, the

less is available to do anything else.

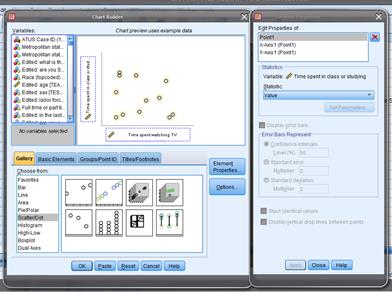

To get this graph,

choose "Graphs \ Chart Builder ..."

and drag the elements to where you want them, like this,

This is the first

type of "Scatter/Dot" graph.

For this graph I

removed the split, since it didn't look like there were significant differences

between men and women in that regard the same "Data \ Split File ... " but now "Analyze all

cases."

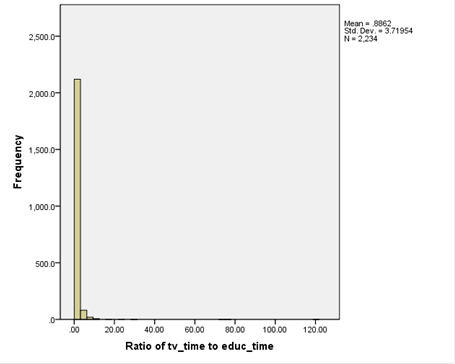

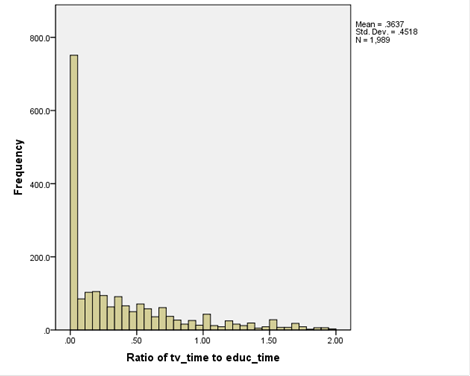

I can create a

histogram of the ratio of time spent watching TV to time spent studying,

But this isn't much

use since it's dominated by the few extreme values of people who spent 100 or

more times as many minutes in TV as studying.

So this histogram,

plots only those

with a ratio less than 2.

(To make this

chart, I used "Graphs \ Chart

Builder ..." and then chose "Bar." When you put in just one variable on the

x-axis it assumes you want a Histogram.)

Now you can go on

to do your own analysis, maybe by race/ethnicity? Or go back and add in video game

playing? Of the people who didn't watch

TV, were there a larger fraction of men or women?

Some

Shortcuts

You can use "Analyze \ Descriptive Statistics \ Explore..." which

asks you to put in the "Dependent

List" which are the variables, whose means you want to find, and

then the "Factor List"

which defines categories, by which the subgroup means are found. So, for example, if you wanted to look at the

time sleeping, depending on whether there are kids in the house, you could put

"Time Sleeping" into

the "Dependent List"

and then "Presence of Household

Children" into the "Factor

List".

You can get fancier if you create your own

factors suppose you wanted to look at time sleeping for African-American,

Hispanic, Asian, and whites at 5 levels of education each (without highschool

diploma, with just diploma, with some college, with 4-year degree, with

advanced degree) for a total of 4 x 5 = 20 different categories. So create a new variable that takes the

values 1 through 20 and carefully code it up for each of those categories. Then put that into "Factor" in

"Explore" and let the machine do your work.

SPSS also has

"Analyze \ Compare Means" but we won't get to that yet (although

you're welcome to explore it on your own!).

Other

Datasets

The class will use

a number of other data sets, which I have provided to you already formatted for

SPSS. These are usually assembled by

government bureaucrats who love their acronyms so they include names like Fed

SCF, NHIS, BRFSS, NHANES, WVS, historical PUMS.

Overview of ATUS data

We will also use data from the

"American Time Use Survey," or ATUS.

This asks respondents to carefully list how they spent each hour of

their time during the day; it's a tremendous resource. The survey data is collected by the US Bureau

of Labor Statistics (BLS), a US government agency. You can find more information about it here, http://www.bls.gov/tus/.

The dataset has information on 112,038

people interviewed from 2003-2010. This

gives you a ton of information we

really need to work to get even the simplest information from it.

The dataset is ready to use in SPSS. Download it from the class page onto your

computer. If it is zipped, then unzip

it. Remember that if you're in the

computer lab, just double-clicking on the SPSS file may not automatically start

up SPSS; you'll get some error code. So

use the Start bar to find SPSS and start it that way. Then open up your dataset once the program

has loaded.

The ATUS has data telling how many minutes

each person spent on various activities during the day. These are created from detailed logbooks that

each person kept, recording their activities throughout the day.

They recorded how much time was spent with

family members, with spouse, sleeping, watching TV, doing household chores,

working, commuting, going to church/religious ceremonies, volunteering there

are hundreds of specific data items!

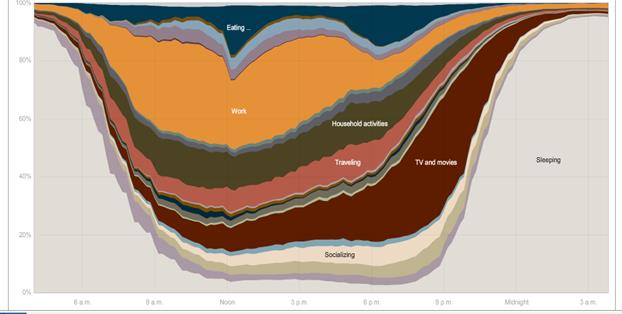

The NY Times had this graphic showing the

different uses of time during the day [here http://www.nytimes.com/interactive/2009/07/31/business/20080801-metrics-graphic.html is the full interactive chart where you can

compare the time use patterns of men and women, employed and unemployed, and

other groups a great way to lose an evening! The article is

here http://www.nytimes.com/2009/08/02/business/02metrics.html?_r=2 ]

To use the data effectively, it is helpful

to understand the ATUS classification system, where additional numbers at the

right indicated additional specificity.

The first two digits give generic broad categories. The general classification T05 refers to time spent doing things

related to work. T0501 is specific to actual work; T050101 is "Work, main job" then T050102 is "Work, other job," T050103 is "Security Procedures related to work," and T050189 is "Working, Not Elsewhere

Classified," abbreviated as n.e.c. (usually if the final digit is a nine

then that means that it is a miscellaneous or catch-all category). Then there are activities that are strongly

related to work, that a person might not do if they were not working at a

particular job like taking a client out to dinner or golfing. These get their own classification codes, T050201, T050202, T050203, T050204, or T050289. The list continues;

there are "Income-generating hobbies, crafts, and food" and "Job

interviewing" and "Job search activities." These have other classifications beginning

with T05 to indicate that they are

work-related.

So for instance, to create a variable,

"Time Spent Working" that we might label "T_work," you

would add up T050101, T050102, T050103, T050189, T050201, T050202, T050203,

T050204, T050289, T050301, T050302, T050303, T050304, T050389, T050403,

T050404, T050405, T050481,

T050499, and T059999. You might

want to add in "Travel related to working" down in T180501. (No sane human would remember all these

codings but you'd look at the "Labels" in SPSS and create a new

variable.) It's tedious but not

difficult in any way.

Some variables are even more detailed

playing sports is broken down into aerobics, baseball, basketball, biking,

billiards, boating, bowling, ... all the way to wrestling, yoga, and "Not

Elsewhere Classified" for those with really obscure interests. Then there are similar breakdowns for

watching those sports. Most people will

have a zero value for most of these but they're important for a few people.

You can imagine that different researchers,

exploring different questions, could want different aggregates. So the basic data has a very fine

classification which you can add up however you want.

Fed

SCF, Survey of Consumer Finances produced by the Federal Reserve

This survey is only

made once every three years; the most recent data is from 2010. The survey gives a tremendous amount of

information about people's finances: how much they have in bank accounts (and

how many bank accounts), credit cards, mortgages, student loans, auto and other

loans, retirement savings, mutual funds, other assets the whole panoply of

financial information. But there's a

catch. As you probably know from class

as well as from personal experience, wealth is very unequally distributed. Some people have few financial assets at all,

not even a bank account. Many people

have only a few basic financial instruments: a credit card, some basic loans

and a simple bank account. Then a few

wealthy people have tremendously complicated portfolios of assets.

How does a

statistical survey deal with this? By

unequal sampling then weighting all of the samples I provide here do this to

one degree or another, but it becomes very important in the Fed SCF. The idea is simple: from the perspective of a

survey about finance, all people with no financial assets look the same they

have "zero" for most answers in the survey. So a single response is an accurate sample

for lots and lots of people. But people

with lots of financial assets have varied portfolios, so a single response is

an accurate sample for only a small number of people. So if I were tasked with finding out about

the financial system but could only survey 10 people, I might reasonably choose

to sample 8 rich people with complicated portfolios and maybe 1 middle-class

person and 1 poor person. I would keep

in mind that the population of people in the country are not 80% rich, of

course! In somewhat fancier statistics,

I would weight each person, so the poor person would represent tens of millions

of Americans, the middle-class person might represent more than a hundred

million, and the rich people would each only represent a few million. If I wanted to extrapolate from the sample to

the population, I would have to use these weights.

Many of the surveys

we'll be using in class are weighted, and if you want to use them correctly

you'll have to do the weighted versions.

I'm skipping that for this class only because I think the cost outweighs

the benefits for students early in their curriculum.

Actually using the

Fed SCF survey can be difficult because the information is so richly detailed. You might want, say, a family's total debt,

but instead get debt on credit card #1, card #2, all types of different loans,

etc. so you have to add them up yourself.

You have to do a bit of preliminary work.

NHIS

National Health Interview Survey

This dataset has

all sorts of medical and healthcare data who has insurance, how often they're

sick, doctor visits, pregnancy, weight/height.

In the US many people have health insurance provided through their work

so the economics of health and economics of insurance become tangled together.

BRFSS,

Behavioral Risk Factor Surveillance System Survey

This dataset has

many observations on a wide variety of risky behaviors: smoking, drinking, poor

eating, flu shots, whether household has a 3-day supply of food and

water... There is some economic data

such as a person's income group.

NHANES

National Health And Nutrition Examination Survey

This has even more

detail but on a smaller sample than the BRFSS.

On whether people have healthy lifestyles: eat veg and fruit, their BMI,

whether they smoke (various things), use drugs, sex (number of partners) lots

of things that are interesting enough to compensate for the dull (!?!?) stats

necessary to analyze it.

There are other

common data sources that are easily available online, which you can consider as

you reflect upon your final project.

IPUMS

This is a

tremendous data source, that has historical census data for past centuries,

from http://www.ipums.org/. Some of the

historical questions are weird (they asked if a person was "idiotic"

or "dumb" which sounds crazy but used to be scientific terms). It includes full names and addresses from

long-ago census data.

WVS

World Values Survey

This has a bit less

economics but still lots of interesting survey data about attitudes of people

of many issues; the respondents are global from scores of countries over

several different years. There is some

information about personal income, education and occupation so you can see how

those correlate with, say, attitudes toward democracy, religiosity, or other

hot issues.

Demographic

and Health Surveys from USAID

These give careful

data about people in developing countries, to look at, say, how economic growth

impacts nourishment.

On

Correlations: Finding Relationships between Two Variables

In a case where we

have two variables, X and Y, we want to know how or if they are related, so we

use covariance and correlation.

Suppose we have a

simple case where X has a two-part distribution that depends on another

variable, Y, where Y is what we call a "dummy" variable: it is either

a one or a zero but cannot have any other value. (Dummy variables are often used to encode

answers to simple "Yes/No" questions where a "Yes" is

indicated with a value of one and a "No" corresponds with a

zero. Dummy variables are sometimes

called "binary" or "logical" variables.) X might have a different mean depending on

the value of Y.

There are millions

of examples of different means between two groups. GPA might be considered, with the mean

depending on whether the student is a grad or undergrad. Or income might be the variable studied, which

changes depending on whether a person has a college degree or not. You might object: but there are lots of other

reasons why GPA or income could change, not just those two little reasons of course! We're not ruling out any further

complications; we're just working through one at a time.

In the PUMS data, X

might be "wage and salary income in past 12 months" and Y would be

male or female. Would you expect that

the mean of X for men is greater or less than the mean of X for women?

Run this on SPSS ...

In a case where X

has two distinct distributions depending on whether the dummy variable, Y, is

zero or one, we might find the sample average for each part, so calculate the

average when Y is equal to one and the average when Y is zero, which we denote ![]() . These are called

conditional means since they give the mean, conditional on some value.

. These are called

conditional means since they give the mean, conditional on some value.

In this case the

value of ![]() is the same as the

average of the two variables multiplied together,

is the same as the

average of the two variables multiplied together, ![]() .

.

![]() .

.

This is because the

value of anything times zero is itself zero, so the term ![]() drops out. While it is easy to see how this additional

information is valuable when Y is a dummy variable, it is a bit more difficult

to see that it is valuable when Y is a continuous variable why might we want

to look at the multiplied value,

drops out. While it is easy to see how this additional

information is valuable when Y is a dummy variable, it is a bit more difficult

to see that it is valuable when Y is a continuous variable why might we want

to look at the multiplied value, ![]() ?

?

Use Your

Eyes

We are accustomed

to looking at graphs that show values of two variables and trying to discern

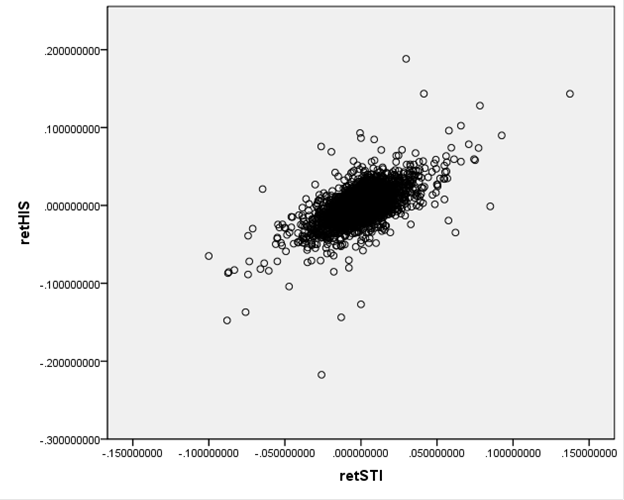

patterns. Consider these two graphs of

financial variables.

This plots the

returns of Hong Kong's Hang Seng index against the returns of Singapore's

Straits Times index (over the period from Dec 29, 1989 to Sept 1, 2010)

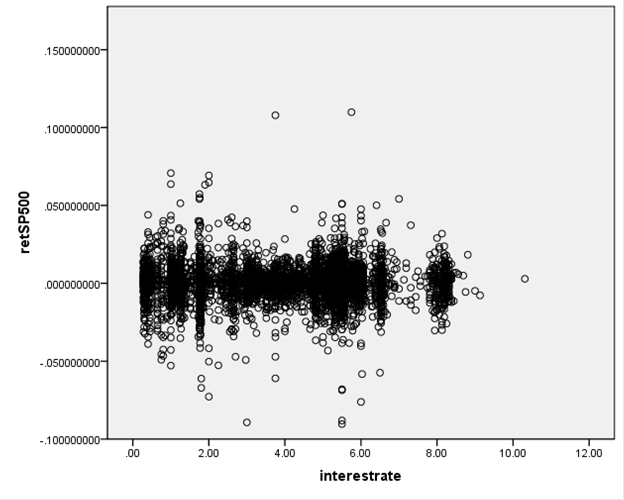

This next graph

shows the S&P 500 returns and interest rates (1-month Eurodollar) during Jan

2, 1990 Sept 1, 2010.

You don't have to

be a highly-skilled econometrician to see the difference in the

relationships. It would seem reasonable to

state that the Hong Kong and

We want to ask, how

could we measure these relationships?

Since these two graphs are rather extreme cases, how can we distinguish

cases in the middle? And then there is

one farther, even more important question: how can we try to guard against

seeing relationships where, in fact, none actually exist? The second question is the big one, which

most of this course (and much of the discipline of statistics) tries to

answer. But start with the first

question.

How can

we measure the relationship?

Correlation

measures how/if two variables move together.

Recall from above

that we looked at the average of ![]() when Y was a dummy

variable taking only the values of zero or one.