Lecture 2: Discrete and

Continuous Random Variables

Kevin R

Foster, CCNY, ECO B2000

Fall 2013

For any discrete

random variable, the mean or expected value is:

![]()

and the variance is

![]() so

the standard deviation is the square root.

so

the standard deviation is the square root.

These can be

described by PDF or CDF probability density function or cumulative

distribution function. The PDF shows the

probability of events; the CDF shows the cumulative probability of an event

that is smaller than or equal to that event.

The PDF is the derivative of the CDF.

Linear

Transformations:

·

If ![]() then Y will have mean

then Y will have mean ![]() and standard deviation

and standard deviation ![]() .

.

·

If ![]() then

then ![]() ;

; ![]() (and if X and Y are

independent then the covariance term drops out)

(and if X and Y are

independent then the covariance term drops out)

WARNING: These

statements DO NOT work for non-linear calculations! The propositions above do NOT tell about when

X and Y are multiplied and divided: the distributions of ![]() or

or ![]() are not easily

found. Nor is

are not easily

found. Nor is ![]() , nor

, nor ![]() . We might wish for a

magic wand to make these work out simply but they don't in general.

. We might wish for a

magic wand to make these work out simply but they don't in general.

Common

Discrete Distributions:

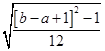

Uniform

·

depend on only upper and lower bound, so all

events are in ![]()

·

mean is ![]() ; standard deviation is

; standard deviation is

·

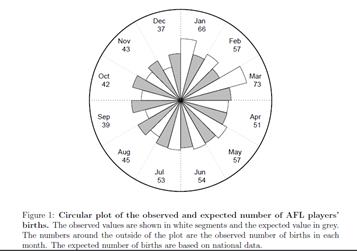

Many null hypotheses are naturally formulated as

stating that some distribution is uniform: e.g. stock picks, names and grades,

birth month and sports success, etc.

from: Barnett, Adrian G. (2010) The relative age effect in

Australian Football League players. Working Paper.

Although note

that distribution of births is not quite uniform; certainly among animal

species humans are unusual in that births are not overwhelmingly seasonal.

Benford's Law: not really a law but an empirical result

about measurements, that looking at the first digit, the value 1 is much more

common than 9 the first digit is not uniformly distributed. Originally stated for tables of

logarithms. Second digit is closer to

uniform; third digit closer still, etc.

See online Excel sheet. This is a

warning that sometimes our intuition about how we might think numbers are

distributed is actually wrong.

Question: Does the "shuffle"

function on your music player distribute songs uniformly?

Bernoulli

·

depend only on p, the probability of the event

occurring

·

mean is p; standard deviation is ![]()

o

Where is

the maximum standard deviation?

Intuition: what probability will give the most variation in yes/no

answers? Or use calculus; note that has

same maximum as p(1 p) so take derivative of that,

set to zero. Then hit your forehead with

the palm of your hand, realizing that calculus gave you the same answer as

simple intution.

·

Used for coin flips, dice rolls, events with

"yes/no" answers: Was person re-employed after layoff? Did patient

improve after taking the drug? Did

company pay out to investors from IPO?

Binomial

·

have n Bernoulli trials; record how many were 1

not zero

·

![]() ;

; ![]()

o

These formulas are easy to derive from rules of

linear combinations. If Bi

are independent random variables with Bernoulli distributions, then what is the

mean of B1 + B2?

What is its std dev?

o

What if this is expressed as a fraction of

trials? Derive.

·

what fraction of coin

flips came up heads? What fraction of

people were re-employed after layoff? What fraction of

patients improved? What fraction of companies offereed IPOs?

·

questions about opinion polls the famous

"plus or minus 2 percentage points"

o

get margin of error depending on sample size (n)

o

from above, figure that

mean of the fraction of people who agree or support some candidate is p, the

true value, with standard error of ![]() .

.

Some students are a bit puzzled by two

different sets of formulas for the binomial distribution the standard deviation

is listed as ![]() and

and ![]() . Which is it?!

. Which is it?!

It depends on the units. If we measure the number of successes in n

trials, then we multiply by n. If we measure the fraction of successes in n

trials, then we don't multiply but divide.

Consider a simple example: the

probability of a hit is 50% so ![]() . If we have 10

trials and ask, how many are likely to hit, then this should be a different

number than if we had 500 trials. The

standard error of the raw number of how many, of 10, hits we would expect to

see, is

. If we have 10

trials and ask, how many are likely to hit, then this should be a different

number than if we had 500 trials. The

standard error of the raw number of how many, of 10, hits we would expect to

see, is ![]() which is 1.58, so with

a 95% probability we would expect to see 5 hits, plus or minus 1.96*1.58 = 3.1

so a range between 2 and 8. If we had

500 trials then the raw number we'd expect to see is 250 with a standard error

or

which is 1.58, so with

a 95% probability we would expect to see 5 hits, plus or minus 1.96*1.58 = 3.1

so a range between 2 and 8. If we had

500 trials then the raw number we'd expect to see is 250 with a standard error

or ![]() = 11.18 so the 95% confidence interval is 250 plus or minus

22 so the range between 228 and 272.

This is a bigger range (in absolute value) but a smaller part of the

fraction of hits.

= 11.18 so the 95% confidence interval is 250 plus or minus

22 so the range between 228 and 272.

This is a bigger range (in absolute value) but a smaller part of the

fraction of hits.

With 10 draws, we just figured out

that the range of hits is (in fractions) from 0.2 to 0.8. With 500 draws, the range is from 0.456 to

0.544 much narrower. We can get these latter

answers if we take the earlier result of standard deviations and divide by

n. The difference in the formula is just

this result, since ![]() . You could think of

this as being analogous to the other "standard error of the average"

formulas we learned, where you take the standard deviation of the original

sample and divide by the square root of n.

. You could think of

this as being analogous to the other "standard error of the average"

formulas we learned, where you take the standard deviation of the original

sample and divide by the square root of n.

Poisson

·

model arrivals per time, assuming independent

·

depends only on ![]() which is also mean

which is also mean

·

PDF is ![]()

·

model how long each line at grocery store is, how

cars enter traffic, how many insurance claims

From

Discrete to Continuous: an example of a very simple model (too simple)

Use computer to

create models of stock price movements.

What model? How complicated is

"enough"?

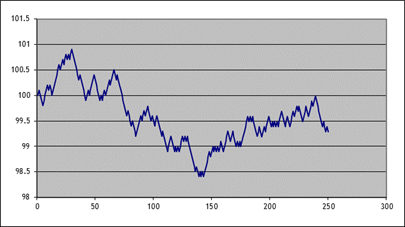

Start really

simple: Suppose the price were 100 today, and then each day thereafter it

rises/falls by 10 basis points. What is

the distribution of possible stock prices, after a year (250 trading days)?

Use Excel

(not even SPSS for now!)

|

First, set the initial price at 100;

enter 100 into cell B2 (leaves room for labels). Put the trading day number into column A,

from 1 to 250 (shortcut). In B1 put

the label, "S". Then label column C as "up"

and in C2 type the following formula, =IF( The "RAND()"

part just picks a random number between 0 and 1 (uniformly distributed). If this is bigger than one-half then we

call it "up"; if it's smaller then we call it "down". So that is the "=IF(statement,

value-if-true, value-if-false)" portion.

So it will return a 1 if the random number is bigger than one-half and

zero if not. Then label column D as

"down" and in D2 just type =1-C2 Which simply makes it zero if

"up" is 1 and 1 if "up" is 0. Then, in B3, put in the following

formula, =B2*(1+0.001*(C2-D2)) Copy and paste these into the

remaining cells down to 250. Of course this isn't very realistic

but it's a start. Then plot the result (highlight

columns A&B, then "Insert\Chart\XY (Scatter)"); here's one of

mine:

|

|

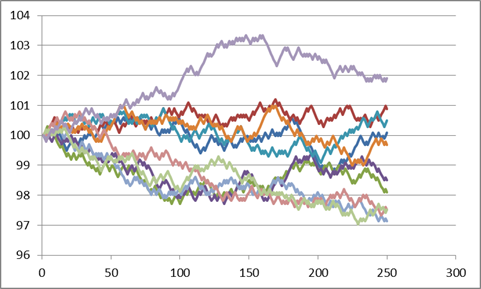

Here are 10 series (copied and pasted

the whole S, "up," and "down" 10 times), see Excel sheet

"Lecturenotes2".

|

We're not done

yet; we can make it better. But the real

point for now is to see the basic principle of the thing: we can simulate stock

price paths as random trips.

The changes each

day are still too regular each day is 10 bps up or down; never constant,

never bigger or smaller. That's not a great

model for the middle parts. But the

regularity within each individual series does not necessarily mean that the

final prices (at step 250) are all that unrealistic.

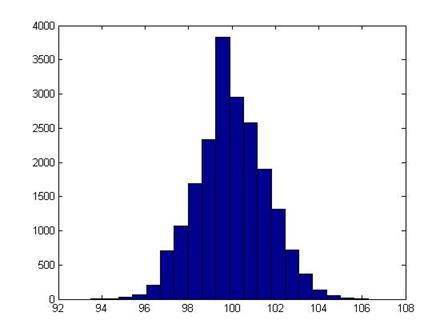

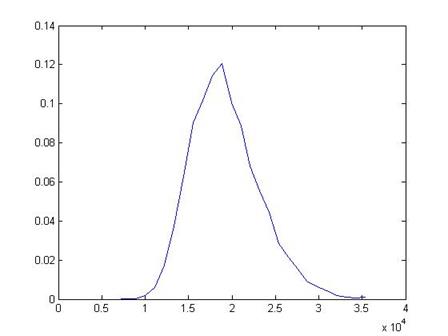

I ran 2000

simulations; this is a histogram of the final price of the stock:

It shouldn't be a

surprise that it looks rather normal (it is the result of a series of Bernoulli

trials that's what the Law of Large Numbers says should happen!).

With computing

power being so cheap (those 2000 simulations of 250 steps took a few seconds) these

sorts of models are very popular (in their more sophisticated versions).

It might seem

more "realistic" if we thought of each of the 250 tics as being a

portion of a day. ("Realistic"

is a relative term; there's a joke that economists, like artists, tend to fall

in love with their models.)

There are times

(in finance for some option pricing models) when even this very simple model

can be useful, because the fixed-size jump allows us to keep track of all of

the possible evolutions of the price.

But clearly it's

important to understand Bernoulli trials summing to Binomial distributions

converging to normal distributions.

Continuous

Random Variables

The PDF

and CDF

Where discrete

random variables would sum up probabilities for the individual outcomes, continuous

random variables necessitate some more complicated math. When X is a continuous random variable, the

probability of it being equal to any particular value is zero If X is continuous, there is a zero chance

that it will be, say, 5 it could be 4.99998 or 5.000001 and so on. But we can still take the area under the PDF

by taking the limit of the sum, as the horizontal increments get smaller and

smaller the Riemann method, for those who remember Calculus. So to find the probability of X being equal

to a set of values we integrate the PDF between those values, so

![]() .

.

The CDF, the

probability of observing a value less than some parameter, is therefore the

integral with ![]() as the lower limit of

integration, so

as the lower limit of

integration, so ![]() .

.

For this class

you aren't required to use calculus but it's helpful to see why somebody might

want to use it. (Note that many of the

statistical distributions we'll talk about come up in solving partial

differential equations such as are commonly used in finance so if you're

thinking of a career in that direction, you'll want even more math!)

Normal

Distribution

We will most

often use the Normal Distribution but usually the first question from

students is "Why is that crazy thing normal?!!" You're not the only one to ask

In statistics it

is often convenient to use a normal distribution, the bell-shaped distribution

that arises in many circumstances. It is

useful because the (properly scaled) mean of independent random draws of many

other statistical distributions will tend toward a normal distribution this

is the Central Limit Theorem.

Some basic facts

and notation: a normal distribution with mean ΅ and standard deviation s

is denoted N(΅,s). (The variance is the square of the standard

deviation, s2.) The Standard Normal distribution is when ΅=0

and s=1;

its probability density function (pdf) is denoted pdfN(x);

the cumulative density function (CDF) is cdfN(x)

or sometimes Nor(x).

This is a graph of the PDF (the height at any point) and CDF of the

normal:

Example of using normal distributions:

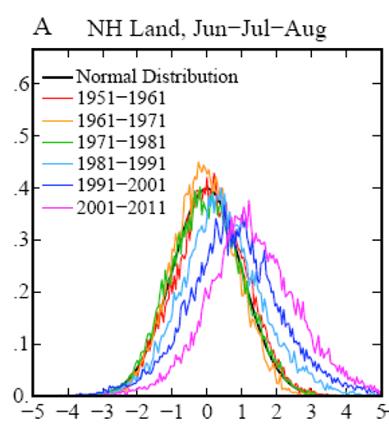

A paper by

Hansen, Sato, & Ruedy (2012) showed these decadal

distributions of temperature anomalies:

This shows the

rightward spread of temperature deviations.

The x-axis is in standard deviations, which makes the various

geographies easily comparable (a hot day in Alaska is different from a hot day

in Oklahoma). The authors define extreme

heat as more than 3 standard deviations above the mean and note that the probability

of extreme heat days has risen from less than 1% to above 10%.

One of the basic

properties of the normal distribution is that, if X is distributed normally

with mean ΅ and standard deviation s,

then Y = A + bX is also distributed normally, with mean

(A + b΅) and standard deviation bs. We will use this particularly when we

"standardize" a sample: by subtracting its mean and dividing by its

standard deviation, the result should be distributed with mean zero and

standard deviation 1.

Oppositely, if we

are creating random variables with a standard deviation, we can take random

numbers with a N(0,1) distribution, multiply by the

desired standard deviation, and add the desired mean, to get normal random

numbers with any mean or standard deviation.

In Excel, you can create normally distributed random numbers by using

the RAND() function to generate

uniform random numbers on [0,1], then NORMSINV(

Motivation:

Sample Averages are Normally Distributed

Before we do a

long section on how to find areas under the normal distribution, I want to

address the big question: Why we the heck would anybody ever want to know

those?!?!

Consider a case

where we have a population of people and we sample just a few to calculate an

average. Before elections we hear about

these types of procedures all of the time: a poll that samples just 1000 people

is used to give information about how a population of millions of people will

vote. These polls are usually given with

a margin of error ("54% of people liked Candidate A over B, with a margin

of error of plus or minus 2 percentage points"). If you don't know statistics then polls

probably seem like magic. If you do know

statistics then polls are based on a few simple formulas.

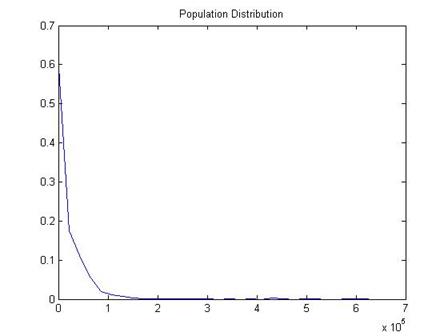

I have a dataset

of about 206,639 people who reported their wage and salary to a particular

government survey, the "Current Population Survey," the CPS. The true average of their wage and salaries

was $19,362.62. (Not quite; the top income value is cut at $625,000

people who made more are still just coded with that amount. But don't worry about that for now.) The standard deviation of the full 206,639

people is 39,971.91.

A histogram of

the data shows that most people report zero (zero is the median value), which

is reasonable since many of them are children or retired people. However some report incomes up to $625,000!

Taking an average

of a population with such extreme values would seem to be difficult.

Suppose that I

didn't want to calculate an average for all 206,639 people I'm lazy or I've

got a real old and slow computer or whatever.

I want to randomly choose just 100 people and calculate the sample

average. Would that be "good

enough"?

Of course the

first question is "good enough for what?" what

are we planning to do with the information?

But we can still

ask whether the answer will be very close to the true value. In this case we know the true value; in most

cases we won't. But this allows us to

take a look at how the sampling works.

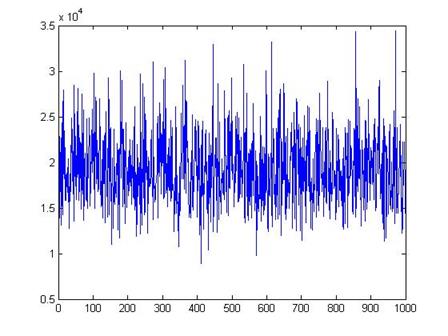

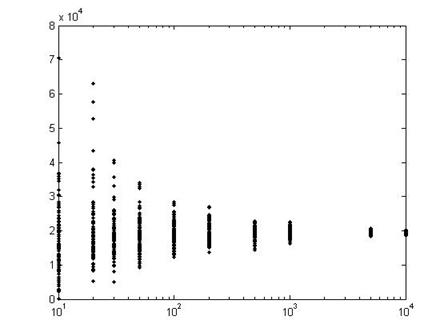

Here is a plot of

values for 1000 different polls (each poll with just 100 people).

We can see that,

although there are a few polls with averages as low almost 10,000 and a few

with averages as high as 30,000, most of the polls are close to the true mean

of $19,363.

In general the

average of even a small sample is a good estimate of the true average value of

the population. While a sample might

pick up some extreme values from one side, it is also likely to pick extreme

values from the other side, which will tend to balance out.

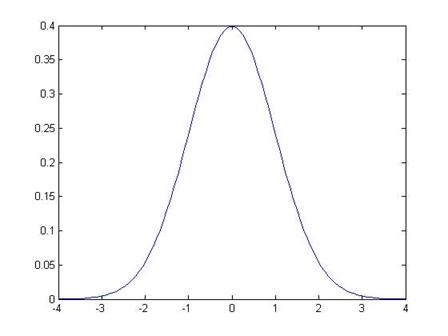

A histogram of

the 1000 poll means is here:

This shows that

the distribution of the sample means looks like a Normal distribution another

case of how "normal" and ordinary the Normal distribution is.

Of course the

size of each sample, the number of people in each poll, is also important. Sampling more people gets us better estimates

of the true mean.

This graph shows

the results from 100 polls, each with different sample sizes.

In the first set

of 100 polls, on the left, each poll has just 10 people in it, so the results

are quite varied. The next set has 20

people in each poll, so the results are closer to the true mean. By the time we get to 100 people in each poll

(102 on the log-scale x-axis), the variation in the polls is much

smaller.

Each distribution

has a bell shape, but we have to figure out if there is a single invariant

distribution or only a family of related bell-shaped curves.

If we subtract

the mean, then we can center the distribution around

zero, with positive and negative values indicating distance from the

center. But that still leaves us with

different scalings: as the graph above shows, the

typical distance from the center gets smaller.

So we divide by its standard deviation and we get a "Standard

Normal" distribution.

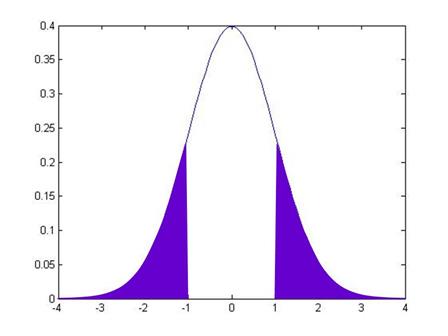

The Standard

Normal graph is:

Note that it is

symmetric around zero. Like any

histogram, the area beneath the curve is a measure of the probability. The total area under the curve is exactly 1

(probabilities must add up to 100%). We

can use the known function to calculate that the area under the curve, from -1

to 1, is 68.2689%. This means that just

over 68% of the time, I will draw a value from within 1 standard deviation of

the center. The area of the curve from

-2 to 2 is 95.44997%, so we'll be within 2 standard deviations over 95.45% of

the time.

It is important

to be able to calculate areas under the Standard Normal. For this reason people used to use big tables

(statistics textbooks still have them); now we use computers. But even the computers don't always quite

give us the answer that we want, we have to be a bit savvy.

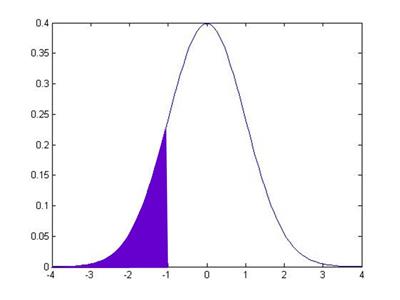

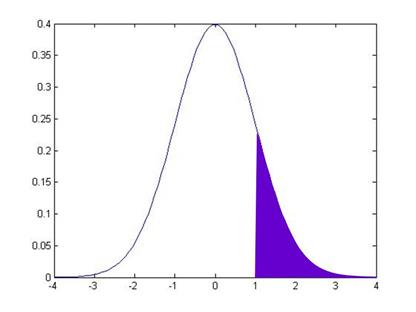

So the normal CDF

of, say, -1, is the area under the pdf of the points to the left of -1:

This area is

15.87%. How can I use this information

to get the value that I earlier told you, that the area in between -1 and 1 is

68.2689%? Well, we know two other things

(more precisely, I know them and I wrote them just 3 paragraphs up, so you

ought to know them). We know that the

total area under the pdf is 100%. And we

know that the pdf is symmetric around zero.

This symmetry means that the area under the other tail, the area from +1

all the way to the right, is also 15.87%.

So to find the

area in between -1 and +1, I take 100% and subtract off the two tail areas:

And this middle

area is 100 15.87 15.87 = 68.26.

Sidebar: you can

think of all of this as "adding up" without calculus. On the other hand, calculus makes this procedure

much easier and we can precisely define the cdf as

the integral, from negative infinity to some point Z, under the pdf: ![]() .

.

So with just this

simple knowledge, you can calculate all sorts of areas using just the

information in the CDF.

Hints on

using Excel, SPSS, and Matlab to calculate the Standard Normal

cdf

Excel

Excel has both normdist and normsdist. For normdist, you need to tell it the mean and standard deviation, so use

the function normdist(X,mean,stdev,cumulative). For normsdist it assumes the

mean is zero and standard deviation is one so you just use normsdist(X). Read the help files to learn

more. The final argument of the normdist function,

"Cumulative" is a true/false: if true then it

calculates the cdf (area to the left of X); if false

it calculates the pdf. [Personally, that's an ugly and non-intuitive bit of coding, but then

again, Microsoft has no sense of beauty.]

To figure out the

other way what X value gives me some particular probability, we use norminv or normsinv.

All of these

commands are under "Insert"

then "Function"

then, under "Select a Category" choose "Statistical".

Google

Mistress Google

knows all. When I google "Normal cdf calculator" I get a link to http://www.uvm.edu/~dhowell/StatPages/More_Stuff/normalcdf.html.

This is a simple and easy interface: put in the z-value to get the probability

area or the inverse. Even ask Siri!

SPSS

For SPSS you can

open it up with an empty dataset and go to the "Data View" tab.

Then use "Transform,"

"Compute Variable

"

and, under "Function Group"

find "CDF and Noncentral

CDF". Then "Cdf.Normal(X,mean,stdev)"

calculates the normal cdf for the given X

variable. Select this function and use

the up-arrow to push it into the "Numeric

Expression" dialog box. For

any of the inputs (which SPSS denotes as "?")

you can click on a variable from the list on the left. Or just type in the values. You need to give your output variable a name,

this is the blank "Target Variable"

on the upper left-hand side. If you're

just doing calculations then give it any name; later on, if you are doing more

complex series of calculations, you can worry about understandable variable

names. Then hit "OK" and look back in the "Data View." (It will spawn an Output view but that only

tells you if there were errors in the function.)

To go backwards,

find "Inverse DF"

under "Function Group"

and then "IDF.Normal(p,mean,stdev)" where you input the

probability.

Matlab

Matlab has the command,

normcdf(X,mean,stdev). The inputs mean

and stdev

are the mean and standard deviations of the normal distribution considered; for

the Standard Normal you can just leave those blank and just write normcdf(X).

If X is a vector or matrix then it computes the standard normal cdf of each cell value.

The function normpdf(X,mean,stdev)

is the pdf naturally.

Norminv(p,mean,stdev) gives the inverse of the normcdf function and normsinv(p) gives the inverse for the standard normal.

Side Note: The basic property, that the distribution is normal whatever the time

interval, is what makes the normal distribution {and related functions, called Lιvy distributions} special. Most distributions would not have this

property so daily changes could have different distributions than weekly,

monthly, quarterly, yearly, or whatever!

Recall from

calculus the idea that some functions are not differentiable in places they

take a turn that is so sharp that, if we were to approximate the slope of the

function coming at it from right or left, we would get very different answers. The function, ![]() , is an example: at zero the left-hand derivative is -1; the

right-hand derivative is 1. It is not

differentiable at zero it turns so sharply that it cannot be well

approximated by local values. But it is

continuous it can be continuous even if it is not differentiable.

, is an example: at zero the left-hand derivative is -1; the

right-hand derivative is 1. It is not

differentiable at zero it turns so sharply that it cannot be well

approximated by local values. But it is

continuous it can be continuous even if it is not differentiable.

Now suppose I had

a function that was everywhere continuous but nowhere differentiable at every

point it turns so sharply as to be unpredictable given past values. Various such functions have been derived by

mathematicians, who call it a Wiener process (it generates Brownian

motion). (When Einstein visited CCNY in

1905 he discussed his paper using Brownian motion to explain the movements of

tiny particles in water, that are randomly bumped around by water

molecules.) This function has many

interesting properties including an important link with the Normal

distribution. The Normal distribution

gives just the right degree of variation to allow continuity other

distributions would not be continuous or would have infinite variance.

Note also that a

Wiener process has geometric form that is independent of scale or orientation

a Wiener process showing each day in the year cannot be distinguished from a

Wiener process showing each minute in another time frame. As we noted above, price changes for any time

interval are normal, whether the interval is minutely, daily, yearly, or

whatever. These are fractals, curious

beasts described by mathematicians such as Mandelbrot, because normal variables

added together are still normal. (You

can read Mandelbrot's 1963 paper in the Journal of Business, which you can

download from JStor he argues that Wiener processes

are unrealistic for modeling financial returns and proposes further

generalizations.)

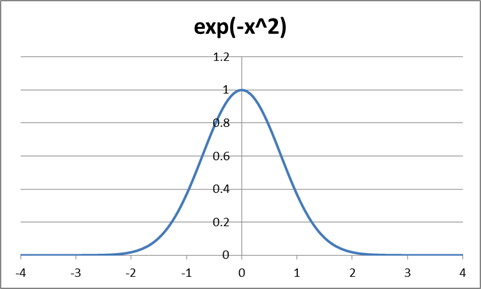

The Normal

distribution has a

pdf which looks ugly but isn't so bad once you break it down. It is proportional to ![]() . This is what gives

it a bell shape:

. This is what gives

it a bell shape:

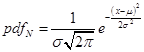

To make this a

real probability we need to have all of its area sum up to one, so the

probability density function (PDF) for a standard normal (with zero mean and

standard deviation of one) is

![]() .

.

To allow a mean,

΅, different from zero and a standard deviation, σ, different from one, we

modify the formula to this:

.

.

The connection

with e is useful if it reminds you of

when you learned about "natural logarithms" and probably thought

"what the heck is 'natural' about that ugly thing?!" But you learn that it comes up everywhere

(think it's bad now? wait for differential equations!) and eventually make your

peace with it. So too the 'normal'

distribution.

If you think that

the PDF is ugly then don't feel bad its discoverer didn't like it

either. Stigler's History of Statistics

relates that Laplace first derived the function as the limit of a binomial

distribution as ![]() but couldn't believe

that anything so ugly could be true. So

he put it away into a drawer until later when Gauss derived the same formula

(from a different exercise) which is why the Normal distribution is often

referred to as "Gaussian". The

Normal distribution arises in all sorts of other cases: solutions to partial

differential equations; in physics Maxwell used it to describe the diffusion of

gases or heat (again Brownian motion); in information theory where it is

connected to standard measures of entropy (Kullback Liebler); even in the distribution of prime factors in

number theory, the ErdősKac

Theorem.

but couldn't believe

that anything so ugly could be true. So

he put it away into a drawer until later when Gauss derived the same formula

(from a different exercise) which is why the Normal distribution is often

referred to as "Gaussian". The

Normal distribution arises in all sorts of other cases: solutions to partial

differential equations; in physics Maxwell used it to describe the diffusion of

gases or heat (again Brownian motion); in information theory where it is

connected to standard measures of entropy (Kullback Liebler); even in the distribution of prime factors in

number theory, the ErdősKac

Theorem.

Finally I'll note

the statistical quincunx, which is a great word since it sounds naughty but is

actually geeky (google it or I'll try to get an online version to play in

class).