|

Midterm Review K Foster, CCNY, Spring 2010 |

|

|

Some important concepts (not necessarily all!)

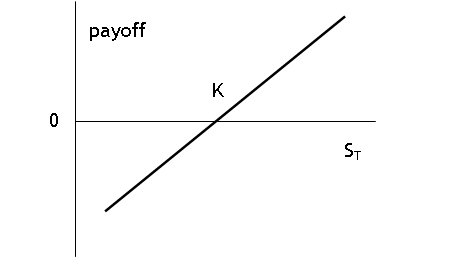

Payoff

to Long forward position = ST K [Payoff to short position = - payoff to long

position = K

ST]

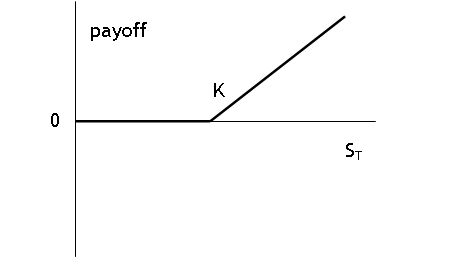

payoff to European call = max{0, ST - K}

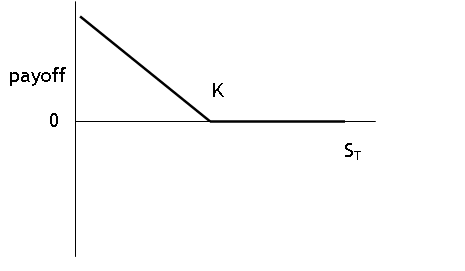

payoff to European put = max{0, K - ST }

In continuous time ;in

compounding at discrete intervals, m, then PDV(r,t,m) =

Hedge is exchanging a volatile price (St becoming ST) for a known price, Ft.

Basis Risk

Cross Hedging

change β of a portfolio

We might be confused

because we might think that the forward price is a predictor of the price that

will be set at that future date. But

it's not the spot price is a predictor.

F0 = S0erT.

"cost of carry" is

c so that for investment assets, ,

while for consumption

assets, where y is the convenience yield, .

FX: .

f = (F0 K)e-rT.

The intrinsic value of an option is its value if it were exercised

today, either max(St K, 0) for a call or max(K

St, 0) for a put.

C value of American call option (sometimes distinguish between C0 and CT, the value now and value at maturity)

P value of American put option

c value of European call option

p value of European put option

Six important factors affecting option prices:

- Current stock price, S0

- Strike, K

- Time to expiration/maturity, T

- Volatility, σ

- risk-free interest rate, r

- dividends of stock over T

Upper Bounds for Option Prices

A call: c ≤ S0 and C ≤ S0; A put: p ≤ K and P ≤ K; in fact p ≤ Ke-rT.

Lower Bounds for Option Prices

c + Ke-rT ≥ S0

so c ≥ S0 Ke-rT

p + S0 ≥ Ke-rT thus p ≥ Ke-rT - S0

Put-Call Parity

c + Ke-rT = p + S0

or

c

p = S0

Ke-rT.

Bull Spread, Bear Spread, Box Spread, Butterfly Spread, Straddle, Strip, Strangle

Tree Model or Binomial Model

,

,

any contingent claim, G(Z), can be priced with the risk-neutral probabilities

as

Delta,