|

Lecture Notes 2, Bonds (Ch 4) and Hedging (Ch 3) K Foster, CCNY, Spring 2010 |

|

|

Learning Outcomes (from CFA exam)

Students will be able to:

§ interpret interest rates as required rate of return, discount rate, or opportunity cost;

§ calculate and interpret the effective annual rate, given the stated annual interest rate and the frequency of compounding;

§ solve time value of money problems when compounding periods are other than annual;

§ calculate and interpret the future value (FV) and present value (PV) of a single sum of money, an ordinary annuity, an annuity due, a perpetuity (PV only), and a series of unequal cash flows;

§ draw a time line and solve time value of money applications (for example, mortgages and savings for college tuition or retirement).

§ describe the characteristics and calculate the gain/loss of forward rate agreements (FRAs);

§ calculate and interpret the payoff of an FRA, and explain each of the component terms;

§ define European option, American option, and the concept of moneyness of an option;

§ differentiate between exchange-traded options and over-the-counter options;

§ define intrinsic value and time value and explain their relationship;

|

|

|

On using these Lecture Notes:

We sometimes don't realize the real reason why our good habits work. In the case of taking notes during lecture, this is probably the case. You're not taking notes in order to have some information later. If you took your day's notes, ripped them into shreds, and threw them away, you would still learn the material much better than if you hadn't taken notes.

The process of listening, asking "what are the important things said?," answering this, then writing out the answer in your own words that's what's important!

So even though I give out lecture notes, don't stop taking notes during class. Take notes on podcasts and video lectures, too. Notes are not just a way to capture the fleeting sounds of the knowledge that the instructor said, before the information vanishes. Instead they are a way for your brain to process the information in a more thorough and more profound way. So keep on taking notes, even if it seems ridiculous. The reason for note-taking is to take in the material, put it into your own words, and output it. That's learning. |

|

|

From

Remember basic definitions: a "basis point" is one-hundredth of a percentage point. So if the Fed cut rates by one half of one percent (say, from 4.25% to 3.75%) then this is a cut of 50 basis points (bp, sometimes pronounced "bip") from 425 bp to 375 bp. Ordinary folks with, say, $1000 in their savings accounts don't see much of a change (50 bp less means $5) but if you're a major institution with $100m at short rates then that can get into serious money: $500,000.

A dollar today is not worth a dollar in the future, even without any inflation. Remember that the true cost of something is its opportunity cost: what must be given up in order to get it. To get a dollar in one year I don't need to give up a dollar today, not when I can put about 97 cents into the bank and, with 3% interest, get $1 in a year's time.

There are 2 basic issues that we must address: the rate of compounding and the fact that interest rates change over time.

Rate of Compounding

We often use

continuously-compounded interest, so that an amount invested at a fixed

interest rate grows exponentially.

Unless you've read the really fine print at the bottom of some loan

document, you probably haven't given much thought to the differences between

the various sorts of compounding annual, semi-annual, etc. Do that now:

|

If $1 is invested and grows at rate R then |

annual compounding means I'll have |

(1 + R) after one year. |

|

If $1 is invested and grows at rate R then |

semi-annual compounding means I'll have |

|

|

" |

compounding 3 times means I'll have |

|

|

… |

… |

… |

|

" |

compounding m times means I'll have |

|

|

" |

… |

… |

|

" |

continuous compounding (i.e. letting |

eR after one year. |

This odd irrational

transcendental number, e, was first used by John Napier and William Outred in

the early 1600's; Jacob Bernoulli derived it; Euler popularized it. It is or

. It is the expected minimum number of uniform

[0,1] draws needed to sum to more than 1.

The area under

from 1 to e is equal to 1.

Sometimes we write eR; sometimes exp{R} if the stuff buried in the superscript is important enough to get the full font size.

Since interest was being paid in financial markets long before the mathematicians figured out natural logarithms (and computing power is so recent), many financial transactions are still made in convoluted ways.

For an interest rate is 5%, this quick Excel calculation shows how the discount factors change as the number of periods per year (m) goes to infinity:

|

m per year |

(1+R/m)^m |

Discount Factor |

|

1 |

1.05 |

0.952380952 |

|

2 |

1.050625 |

0.951814396 |

|

4 |

1.0509453 |

0.951524275 |

|

12 |

1.0511619 |

0.951328242 |

|

250 |

1.0512658 |

0.95123418 |

|

360 |

1.0512674 |

0.951232727 |

|

|

|

|

|

infinite |

1.0512711 |

0.951229425 |

So going from 12 intervals (months) per year to 250 intervals (business days) makes a difference of one basis point; from 250 to an infinite number (continuous discounting) differs by less than a tenth of a bp.

A bond should be worth the present discounted value of its cash flows. Actually any financial instrument (if the flows are known with certainty) ought to be, which is why we want to work out the discounting on simple bonds before getting to more complicated payoffs.

What is present discounted value (PDV)?

Recall that we first determine the schedule of cash flows and then discount those back to the present. The schedule of cash flows can be most easily represented as a timeline, so for example payments of $100 in 3 months, $200 in 6 months, and $300 in 9 months, then a payment of $5000 in 12 months, would be represented as:

But we need to be precise about the units. The $100 in 3 months is not 100 of today-dollars but 100 of today-plus-3-months-dollars. You might not usually make a precise distinction but, for a large institution, the difference is important. Cash has an opportunity cost. So we could write the present discounted value as:

$T=.25 100 + $T=.5 200 + $T=.75 300 + $T=1 5000.

(Note that time is measured

in years so 3 months is of a year.)

But adding different units

gives us a meaningless result we need to get these values into common

units. We want to find some ratio (a

discount factor) that gives

for each future date, T.

So the PDV would be

calculated as these cash flows times some function that accounts for the time

delay. Of course we can't have just time

economics says that just a quantity is never

enough, we need a price too! What is the price of time? Sounds like a deep philosophical issue but

economists answer "interest rate."

So we include the quantity

(time) and its price (the interest rate) into a function which we will (for

now) label PDV(T,r). This function gives

the ratio, .

So the PDV of the bond with the timeline shown above is

We measure T in years so we can then substitute in for the different values, getting:

What is the function,

PDV(T,r)? It can take one of two basic

forms, depending on whether we are considering continuous time or discrete time

periods. In continuous time ,

sometimes written as exp{-rT} so that we don't need to squint at the

superscript. We'll assume continuous

time for a while here.

This would be simple if the interest rate, r, were constant over the entire time period. We will start with that simple case but we want to work up to the more complicated version. So for the example above, if the interest rates are unchanging over the next 12 months then r.25 = r.5 = r.75 = r1 = r and this function is:

= 100 e-.25r + 200 e-.5r + 300

e-.75r + 5000 e-r

If r = 0.06 (a 6% interest

rate) then we can easily calculate this value using a table in Excel.

|

A |

B |

C |

D |

E |

|

|

T= |

r= |

discount

factor |

cash flow |

discounted

cash flow |

|

|

0.25 |

0.06 |

0.985112 |

100 |

98.511194 |

|

|

0.5 |

0.06 |

0.970446 |

200 |

194.08911 |

|

|

0.75 |

0.06 |

0.955997 |

300 |

286.79924 |

|

|

1 |

0.06 |

0.941765 |

5000 |

4708.8227 |

|

|

|

|

|

|

|

|

|

|

|

|

|

5288.2222 |

sum of

discounted cash flows |

First set a column that

gives the T to use at each date when there is cash flow (column A). Then figure out what interest rate applies

for cash discounted from that date (column B), and the cash flow on that date

(column D). Then the discount factor (in

continuous time) is exp(-rt) (column C).

The discounted cash flow is the product of the discount factor and the

cash flow (column E); then the sum of the discounted cash flows is the present

discounted value.

Changing Interest Rates over Time

If the interest rate

changes over the period, then we have to account for the changing interest

rates. How do we do this? We have to distinguish between two types of

interest rates: those measuring the rate from today until some date in the

future ("zero rate") and those measuring the rate from some date in

the future to some date even farther into the future (forward rates). The zero rate can be thought of as the

average of all of the forward rates.

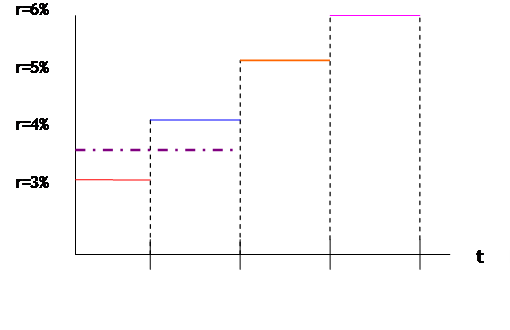

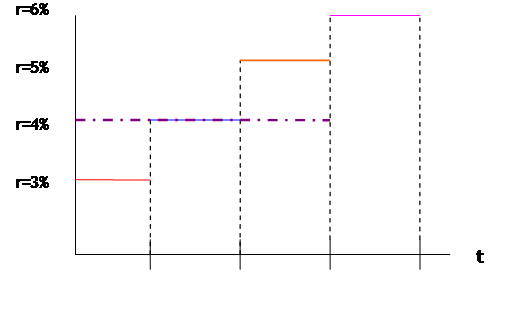

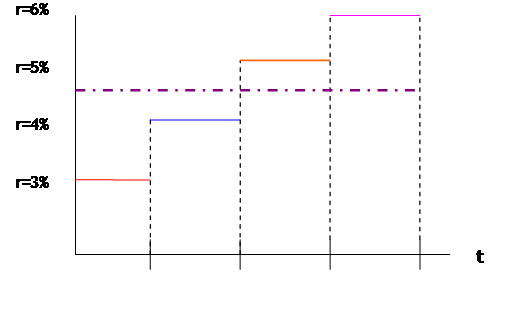

If we graph the evolution

of the interest rate then we might have a graph like this:

where the interest rate

over the first quarter is 3% and then the interest rate over the second quarter

(from the first quarter to the second quarter) is 4%. The zero rate for the first-and-second

quarters is 3.5%, the average, which is the dot-dash line in the picture. If the interest rate in the third quarter

rises to 5% then the zero rate for the first-second-and-third quarters (the

3-quarter zero rate) is 4%, which is the average of 3, 4, and 5 percent:

Then, finally, if the

interest rate during the fourth quarter is 6%, the one-year zero rate is 4.5%,

which is the average of 3, 4, 5, and 6.

If interest rates for the

first quarter are 4% and the forward rate for the second quarter is 6%, then

the forward rate over the third quarter is 3% and the forward rate over the

fourth quarter is 5%, then the average rate is 4.5% -- this would be the rate

over the whole year (the one year zero rate).

If we are interpolating

rates over different periods then we need to worry about weighted

averages. Suppose that we have one forward

rate going from T1 to T2, which we call RF. The zero rate over T1 is R1. To find the zero rate over T2,

just take the weighted average, so that

so that

or, equivalently,

.

To find a forward rate from

the zero rates, the formula is .

In the language of micro,

the forward rate is the marginal rate, which changes the zero rate.

If the path of the interest

rate is more complicated then the formulas can get more complicated (each

interest rate would be multiplied by a weight representing the fraction of the

time period during which the interest rate had that value). [In an

extreme case where the interest rate is continuous then we would integrate,

Rieman-style, over the intervals.] The instantaneous

forward rate at time T is .

Generally for bond pricing,

we want to use the zero rate for the appropriate time period in each PDV( )

function.

Forward Rate Agreement (FRA) is

where company trades a fixed rate (for some future period of time) against the

actual rate that occurs in that future period.

If the one-year rate is 5% and the 2-year rate is 5.5%, then that means

that the forward rate (from one to two years out) is 6%. Suppose that I don't have money to invest

today, but I expect to have it in one year, so I can't buy a 2-year bond but I

still want to lock-in that 6% rate. The

FRA solves this problem. Define RK

as the agreed forward rate, RM as the actual market rate, L is the

principal amount, and the time goes from T1 to T2. Then one company gets L(RK RM)(T1

T2) and the other gets the

negative.

Often theory tells us to

use a "risk-free" interest rate in valuing some financial asset. In the US, securities issued by the Federal

government, such as T-bills and Treasury bonds are generally defined as

risk-free; but traders commonly use LIBOR 1-mo, 3-mo, 6-mo, 12-mo. This is from the Euro-currency market (often

cited as "Eurodollar" market, even though it's not necessarily in its continued existence is a reminder of how

technology allows disintermediation of regulators!).

If you remember your

money-and-banking class, monetary policy is typically made by the Fed using

Repos (repurchase agreements) often overnight.

Let's go back to the

example of the stream of cash flows:

But now with the interest

rate changing (along the path that we showed in the graph above), so we need to

find the zero rates. The one-quarter

zero rate is 3%. The second quarter

forward rate is 4% so the zero rate is 3.5%.

The third quarter forward rate is 5% and the three quarter zero rate is

4%. Finally the fourth quarter forward

rate is 6% so the one-year zero rate is 4.5%.

So we substitute these values into the equation:

then use the continuous-time PDV function of

exp{ } to get:

.

To again create a table we

just change the values of the zero interest rate over each time period:

|

T= |

r= |

discount

factor |

cash flow |

discounted

cash flow |

|

|

0.25 |

0.03 |

0.992528 |

100 |

$

99.25 |

|

|

0.5 |

0.035 |

0.982652 |

200 |

$

196.53 |

|

|

0.75 |

0.4 |

0.740818 |

300 |

$

222.25 |

|

|

1 |

0.045 |

0.955997 |

5000 |

$4,779.99 |

|

|

|

|

|

|

|

|

|

|

|

|

|

$5,298.02 |

sum of

discounted cash flows |

So the steps required to

calculate the present discounted value are:

1.

figure out at

what time every amount of cash flows in or out,

2.

figure out

whether the compounding is to be done continuously or over discrete time,

3.

figure out the

zero rate for each of the relevant times when cash flows,

4.

calculate the

discount factors

5.

multiply the

cash times the discount factor to get the discounted cash flow

6.

sum the

discounted cash flows.

The formula would be

,

where ci is the

cash flow at date i, ri is the zero rate to that time period, and ti

is the time (expressed in fractions of one year) and B is the price of the

bond.

Certain types of cash flows

are discounted using continuous-time compounding while other sorts of cash

flows are discounted at discrete intervals.

You can think of these schedule differences as just different units of

measurement, like Celsius and Fahrenheit.

Discrete Compounding

Sometimes we work in

discrete time units, so the interest paid to $1 at rate R, if compounded m

times, is . So the discounted value of a dollar after 1

year is

(note the negative sign in the exponent) and

the discounted value after T years is

. So if we are compounding at discrete

intervals, m, then we have PDV(r,t,m) =

and we can consider PDV(r,t,∞) as exp(-rt) a

limiting case.

So to take the example

above, with

$T=.25

100 + $T=.5 200 + $T=.75 300 + $T=1 5000.

worth

=

then we put in this

different PDV function. So if we put

this into Excel, if the interest rate were constant and m=0.5 (semi-annual

compounding) then the bond is worth:

|

t |

r |

m |

PDV |

cash |

discounted cash value |

|

0.25 |

0.06 |

0.5 |

0.998302 |

100 |

99.8302 |

|

0.5 |

0.06 |

0.5 |

0.996606 |

200 |

199.3212 |

|

0.75 |

0.06 |

0.5 |

0.994913 |

300 |

298.4740 |

|

1 |

0.06 |

0.5 |

0.993223 |

5000 |

4966.1167 |

|

|

|

|

|

|

|

|

|

|

|

|

|

5563.7420 |

The difference in valuation

is not small, from 5564 to 5298, so you might ask why such a difference? Which one is right? The answer is that it depends on your

opportunity cost which valuation more accurately characterizes

your next-best use of the funds?

(Alternately we rely on past precedent: certain bonds are typically

valued in certain ways, so that's how we do it.)

Going Backwards

Having worked out how to

value a bond from a given set of interest rates, then we can invert the function

and ask how to find interest rates from bond prices. This is the more typical case: bonds are

traded but interest rates are not usually directly traded. A bond that pays a fixed schedule of money

has a present discounted value which is its price. If we don't know what interest rates were

used to get the market price of the bond, then we have to work backwards from the present discounted value back to the

interest rates that were used for the discounting.

The simplest case is a bond

that pays zero coupons but only makes a single repayment. For instance if a bond makes a single payment

of 7000 in one year then the present discounted value is the market price. If we assume that there is discrete

compounding only once per year then the market price, P, is 7000/(1+r). If we knew r then we could find the valuation

of the bond; if we know the market price then we know the implied interest

rate. This rate is the bond yield, the interest rate that

makes the bond valuation equal to its price.

In the simple example above, where P = 7000/(1+r), we can see the

inverse relationship between interest rates and bond prices. When rates rise, bond prices fall and vice

versa. If instead it were continuously

compounded then P=7000e-r.

Again you can see the inverse relationship.

Bonds typically are issued

at some notional "par value" (sometimes the "face value")

which is the notional amount that the interest is computed from. For instance a bond might have a par value of

1000 and pay 50 per year forever this is a five percent par yield. But as interest

rates change subsequent to the bond's issuance, its market price will also

change and the par value will become just a relic of history.

The bond yield gets more complicated as the number of cashflow dates

rises since we are trying to make more inferences. If we have a bond that, say, returns $3000

after 1 year and $4000 after 2 years then with simple annual compounding the

value is 3000/(1+r1) + 4000/(1+r2)2. If we have only the market price then we can

make no further progress we have a single equation with two

unknowns. If we know either of the zero

rates (or if we know that the interest rate remained constant, or some other

relationship between r1 and r2) then we can solve for the

implied bond yield.

Bond yield

is the single constant discount rate, applied to the actual coupon payments,

that makes the bond price equal to its market price. (If there were no coupon payments, then this

is just the zero rate that gives the current bond price.)

Par yield

is the coupon rate that causes the bond price to equal its par value (the

principal).

Examples:

Find the present discounted

value of $1000 paid in six months, if the 7% interest rate is compounded

continuously.

= 1000 * PDV(0.5, 0.07) = 1000 e-.5*.07 =

1000 * 0.965605 = $965.61

We can, of course, work

backwards as well. If the market values

a bond, that pays $1000 in six months, at $965.61, then what continuous-time

interest rate is implied?

Now we set 965.61 = 1000 * PDV(0.5,r) = 1000 e-.5r

so 0.96561 = e-.5r and ln(0.96561) = 0.5r so that r = 0.06999, which

is 7% with a bit of rounding error.

|

|

Now do the same exercise

if interest is semi-annual, quarterly, or monthly. We have = 1000 * PDV(0.5, 0.07,m) where m=2, 4, or 12. which is

For m=2, this is

1000/(1.035) =966.18; for m=4 this is 965.90; for m=12 this is 965.70. |

The remainder is steadily

working up new details.

Now to find the present

discounted value of $1000 paid in 6 months and in 12 months, if the interest rate

is still constant at 7% compounded continuously, this is 1000 * PDV(0.5, 0.07)

+ 1000 * PDV(1, 0.07) = 1000 e-.5*.07 + 1000 e-1*.07 =

965.604 + 932.39 = 1898.

Working backwards again, if

the market values this bond at 1898 then what interest rate is implied? Again, set 1898 = 1000 * PDV(0.5, r) + 1000 *

PDV(1, r) = 1000 e-.5r + 1000 e-1r. Now

we have to remember the rules of exponents: we can't just add the two terms

together (just like x2 + x3 ≠ x5!). So we can use a computer to figure out which

values of r give the correct bond value.

You could experiment with some different values to figure out that,

indeed (what a shock!) r = 0.07 does, indeed, work. It's a numerical problem; there is no general

analytic solution.

Note that the interest rate

used for discounting has absolutely nothing to do with the par yield! A bond might be sold with a $100,000 face

value paying $5000 annually, implying a 5% par yield. But if interest rates rise then that bond

isn't worth as much (& vice versa) the "5%" isn't relevant in any way

once the bond has been issued.

Next with interest rates

changing over time. So the rate for

three months forward is different from the rate six months forward, because the

rate for 3-6 months ahead is different.

Consider two bonds that pay

a quarterly coupon and, so, we use quarterly compounding to find their present

value. One bond, with face value of

$100,000, pays its final quarterly coupon ($1200) in one quarter as well as the

100,000 of principal. The other bond

pays a quarterly coupon in one quarter and then, 2 quarters from today, makes

its last quarterly payment and its par value.

From the market prices of those two bonds, find the implied zero rates

for one quarter and for two quarters, as well as the second quarter forward

rate. If the market gives a price for

the shorter-term bond of $100,074.17 and a price for the 2-quarter bond of

$99,903.31 then we have two equations:

$100,074.17

= and

$99,903.31

= .

To solve, we would first

calculate the bond yield implied for the first bond to get r1 =

0.045 = 4.5%. Then once we have r1

we can substitute into the second equation and find that r2 =

0.05. So the forward rate over the

second quarter must be 5.5% (enough of a rise to get the average of 4.5% and

5.5% up to the 5% zero rate).

If the same question were

posed but with continuous compounding then the precise value of the interest

rate would change. Now we would have two

equations that:

$100,074.17

= (100000+1200)exp(-.25r1) and

$99,903.31

= 1200 exp(-.25r1) + (100000+1200) exp(-.5r2).

Again these equations can

be solved one at a time, knitting up the solutions from the first equation on there is no reason we couldn't do this for

every quarter for the next 30 years! (That sounds like a good exam question, doesn't it? I'm joking, of course, 30 years is too many…)

This method would work just

as well if the first bond made no payments for a year (so it paid 101200 after

5 quarters) while the second bond made a payment of 1200 in 5 quarters and then

101200 in 6 quarters. The discount

factor would be larger but the basic solution strategy would be the same.

All of these interest rates

are part of the yield curve, which shows the interest rates over different time

horizons. This set of zero rates

(derived from bond prices) is then useful for discounting other cash flows.

For some bonds there may

not be enough quoted prices to figure out every step of the yield curve so

analysts would have various methods for filling in the holes.

Once we get accustomed to

using interest rates to figure out bond prices, we want to then find a quick

rule that avoids the complicated math (it's tough to figure e to decimal powers

or natural logs in your head!). This is duration it approximates the percentage change in a

bond price for a given change in the interest rate; so

.

Duration is the time at which the cashflows are paid, with the weighting as

just the present discounted value of the cashflow, so

.

If duration is in discrete

time then we replace the exp{ } function with the appropriate PDV function and

the term is called modified duration.

The rate at which duration

changes, as the interest rate changes, is convexity

(it is the second derivative with respect to changes in the interest rate).

Don't worry about the formula for now but later, if you do a fixed-income securities

class or need it for your job, you can remember that you've heard of it.

Recall payoff graphs, nets

to positions including call/put.

Chapter 3

concentrates on hedgers.

A hedge is basically

locking in cash flows at an early date before the asset changes hands. Consider a position, St, that will

have value ST at some future date, T. If that asset is hedged then a forward is

sold at time T and bought at time t, so that the net asset position is ST

FT + Ft. We expect that, by the time of expiration,

the spot and futures price will be equal (or else there would be arbitrage

opportunities) so we expect that, by date T, ST

FT = 0. So the hedge is exchanging a volatile price

(St becoming ST) for a known price, Ft.

Short Hedge:

own an asset and short a forward to sell at a pre-specified price.

examples: gold mines might sell the gold, that's

still in the ground, at pre-determined prices at some date in the future to

"lock in" a profit; farmer can sell the crop forward; exporter with

short-term receivables might pre-sell (sell forward) to lock in a profit rate. Consider an insurer selling annuities in

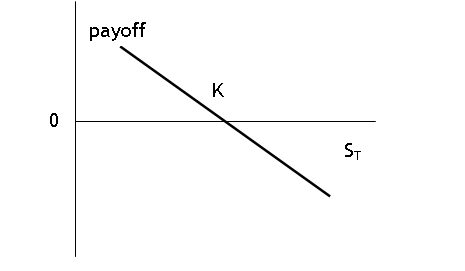

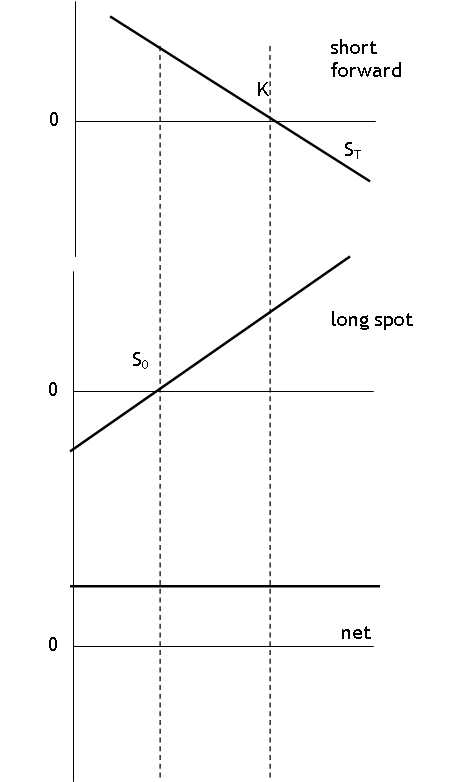

Payoff Graphs: a short

forward position at strike price K pays off as:

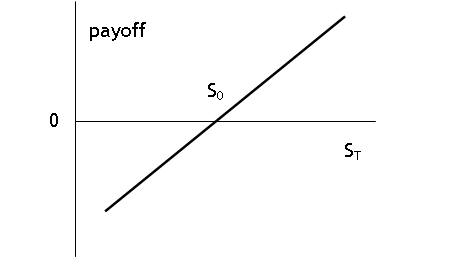

While a long spot position

(at S0) pays off as:

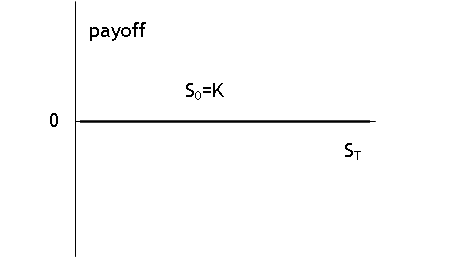

So if S0 = K

then when we add together the two payoff graphs then the net payoff to the

portfolio (of one long spot position plus one short forward) is zero

everywhere:

If the price at which the

initial asset was bought (S0) is not the same as the forward price (K)

then the net payoff is a bit more complicated:

To find the net position

graphically, just line up the two graphs of the base positions, find a

convenient point (where one or the other is zero) and add. Then move right or left, figuring out how

much one payoff increases and the other payoff decreases (if there is a hedge).

So could do others: if

K<S0, for non-hedge positions (both long or both short).

Hedge can be considered by

comparing the money lost on the asset position with the money gained from the

offsetting hedge. For instance, if the

insurer above is getting ¥100,000,000 in 3 months. Right now the rate is 90¥/$ so this is worth

$1,111,111 (=100m/90). If the rate

increases to 95¥/$ then this is worth only $1,052,632. The movement of ¥5 in the FX rate meant a

loss of $58,480 on the asset position.

If the forward price is also 90¥/$ then selling ¥90 forward (getting one

dollar delivered in 3 months) would mean that, if the yen increased to 95 per

dollar then the short forward position would mean that the company could sell

¥90 for $1 and still have ¥5 left over to buy dollars (0.0526 worth). This 5-penny gain is small compared to the

$58,480 loss but the company could sell more than ¥90. How many 90¥/$ contracts? 58,480/0.0526 =1,111,111 worth (which is

exactly the number we discovered earlier).

This might seem like the long way to go about it but it is worth showing

the basic method: one position loses a certain amount; it can be hedged if I

can find some other position that would gain that same amount. Most companies use hedges with much more

complicated structures, but the basic idea remains: construct two offsetting

positions so that, as one loses the other gains (and vice versa).

Long Hedge:

will buy an asset in the future and buy a forward to but at a pre-specified

price.

examples: manufacturers that use mining products

(gold, copper, etc) or plastics can buy in advance and lock-in their

costs. Southwest Airlines made huge

profits, compared with some of their competitors, when they bought fuel forward

for mid 2008 before the oil price rose drastically. Their competitors had to pay higher prices

while Southwest reaped the profits.

(Their competitors, of course, noted that by 2009, when fuel prices had fallen,

then Southwest was paying extra for insurance.)

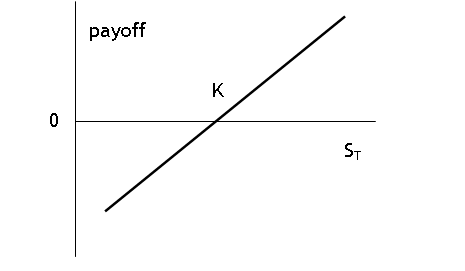

A long forward pays off as

Can work an example in

reverse (as above): how to hedge a short position today with a long forward.

Plenty of individuals

hedge, even though they might not realize it.

Property owners choosing mortgages must choose between fixed-rate (where

the interest rate paid is constant for the life of the loan) or variable or

varieties in-between (sometimes a rate is fixed for a few years at first and then

varies more often). A business, that

employs a person at a fixed salary even though the employee's productivity

might vary, is, in some way, hedging.

Most insurance companies pass along risks through re-insurance, which

are then shared among a wide net of different financial companies.

Why do so many companies

hedge? Wouldn't their investors want

exposure to certain risks? For instance

investors might buy shares in both Exxon/Mobile (that does well when oil prices

rise) as well as Ford (which does worse as oil prices rise). If both companies hedge their positions, then

that risk-diversification is lost. (An

investor would have to buy shares in the counter-parties.) Insurers take a hit from hurricanes (like

Katrina) but many pass along the risks as they hedge their positions (there are

catastrophe bonds that are linked to occurrences of natural disasters).

But the reality is that

many companies forecast their earnings, go through a great deal of effort to

communicate this "guidance" to the analysts following their shares,

and they know that their share price falls when they don't meet expectations;

it's difficult to communicate the many sources of risk that might be faced by a

global company with revenues in many different currencies and costs paid for

many different goods. Even internally, a

company might want to sort out whether a particular division made money by luck

(a favorable FX move) or skill (even after hedging they still out-performed). A hedge means that the company can set its

benchmarks and make profits only in its particular areas of comparative

advantage. Return to the example of the

gold mine: by selling forward they commit that they will make profit if they

are efficient at extracting gold; they will lose money if they are not efficient

at that. Random fluctuations in gold

prices will not drive their results; their profits instead come only from their

own efficiency.

Competitive pressures can

also be important and so every industry (even every firm) must make decisions

based on their own particular needs.

Finally, these hedges might

allow a company to spread the risk more broadly to willing investors. An individual company might hedge in order to

pass the risk on to the global financial markets. Instead of a small number of companies losing

a lot of money, a large number of investors around the world can each lose a

small amount.

Most hedging is not perfect

the real world is messier. Basis

= St

Ft.

If the asset that is held and the futures contract are the same then at

expiration the Basis should be zero. So

if the position is opened at time t and closed out at time T, then we would

like ST=FT. Define

bt = St

Ft and bT = ST

FT.

Then if the company has assets St, it could choose not to

hedge, in which case it would have ST at the end of the period. If it hedges then it would still get the

return of ST at the end but would then accrue profits to the forward

positions, Ft

FT, so the net position would be [this is the same formula as at the

beginning, just with a slightly different interpretation]

ST

+ Ft FT = Ft + bT.

If it is a perfect hedge

then the basis is zero at time T and the value is known at time t; if the basis

is not zero then there is residual risk basis

risk. This is generally common when

the asset position is not one of the standard contracts traded on

exchanges.

This basis risk could have

many sources: perhaps a local oil company would like to hedge its costs. Heating oil is traded on NYMEX but the price

paid by an oil company (at its local delivery) is not quite the same as the

NYMEX price (delivered to NY harbor). Or

sales are not known exactly so the company hedges a substantial fraction of its

anticipated sales (but not all). Or a

company hedges individual stock holdings (on a company with a high beta) with,

say, S&P500 index futures (to save trading costs). Or a company's bonds could be hedged with

forward Treasuries and options on the company stock.

If we consider a

distinction between St (the asset held) and St* (the

asset that is traded on a market) then the position will be ST FT + Ft. If we add and subtract ST* then we

can rearrange that to get Ft + (ST* - FT) + (ST

ST*)

the first term in parentheses is the basis

risk between the "ideal" asset and its forward price; the second term

in parentheses is the basis from the difference in assets. For instance, a bank or insurance company

might want to hedge positions, where customers are guaranteed some rate of

return, using mixtures of Treasuries and private debt.

There is the further

complication of when the forward should mature.

Often traders do not want a forward that expires at the same time they are planning on closing out the position

for cash and don't want to be bothered with actual delivery! So they choose a contract that matures as

short a time afterward as is possible.

(After, since they don't want to accidentally take delivery!) Since short-term markets have the greatest

liquidity, someone hedging a large position might use a series of short

contracts (again this rolling hedge does not deliver complete hedging).

Cross Hedging is used if there is no contract traded forward that is exactly what

the firm desires. High-paid

professionals exert a great deal of ingenuity to figure out how to hedge

various positions that their companies enter.

The hedge ratio, h, is the

number of forwards that must be bought per unit of the asset. If the asset and forward are the same thing,

then the hedge ratio is one. But

generally it will be different because there are more underlying cash flows

than traded contracts.

Can think of this as an

econometrics problem: want to explain the variation in some Y variable (ΔS) as

a linear combination of X variable, (F). The minimum-variance hedge is the

best-fitting coefficient, b, in the equation

.

When the position expires

at T, the value of each asset is ST and the profit from the forward

position is FT Ft.

Define NA as the number of assets held and NF as

the number of forwards so that h = NF/NA. So the total position value is

= NAST

NF(FT

Ft).

Add and subtract NASt

and get

= NASt

+ NA(ST St)

NF(FT

Ft).

= NASt

+ ΔSNA ΔFNF.

= NASt

+ NA(ΔS hΔF).

To minimize the variance of

this term, since NA and St are known, means minimizing

the variance of (ΔS hΔF).

Recall from your stats

course that a term, aX + bY has variance of ,

where ρ (rho) is the correlation coefficient. (Go back to your stats book, or integrate it

yourself, or just trust me). So the

variance of (ΔS

hΔF) is

. To minimize this term with a choice of h, we

set the first derivative equal to zero so

and h* =

.

This should seem sensible:

if ρ=1 and σS = σF then the

hedge ratio is 1 (just like it should be).

If the forward price were twice as volatile as the spot price, then you

would get h= since then you would need only half as many

positions to hedge. If the forward and

spot price are not perfectly correlated (two assets that generally move

together but not perfectly, so perhaps ρ = 0.75

then again fewer forward positions would be needed. The hedge ratio, h, can be found from

historical data as the slope of a regression line of ΔS against ΔF.

(This assumes that past performance gives information about future

returns.)

The value of the total

hedge should be h*NA. If we're using

futures contracts that are each QF units, then .

A stock index is often used as a hedge. Since they weight by market capitalization,

however, a hedge can gradually erode as weights change slightly. A stock bubble can lead to distortions.

Recall, from your previous coursework, the discussion of a stock or portfolio β (Beta) it measures how sensitive the stock or

portfolio is relative to movements in the whole market; in the simplest case it

can be found by regression of the excess returns on the stock (over the

risk-free rate) upon the excess market returns (again, over the risk-free

rate). A stock with a high beta will

track the market closely; a stock with a near-zero beta will be uncorrelated

with the market. As the econometrics

example from cross-hedging discussed, there should be a link between hedging

and market beta. In general,

h* = β.

A non-perfect hedge can

change the beta of a portfolio as well, so a portfolio might be incompletely

hedged in order to take on more risk or shed risk (as the portfolio manager

desires). If the original portfolio has β, and desires to change to β', then instead of taking a hedge ratio h = β, should take either h = (β β')

{if β > β'} or h = (β' - β) {if β < β'}.

A fully-hedged portfolio in

the stock market will grow at the risk-free rate. (Since a fully-hedged portfolio is riskless,

this makes sense two riskless assets should have the same

return.) Why hedge, then? This allows the company to earn returns

entirely from its ability to pick stocks, for example: a company with a

meticulously-chosen portfolio that is fully hedged against an index will earn

the risk-free rate plus the differential return accruing to its stock-picking

skill. Many other companies want

exposure to other asset baskets and want to minimize their exposure to

aggregate market risks.

Note that one person's

hedge is sometimes another person's speculation. Hedge funds were originally set up to take

positions that were well hedged (thus the name) but gradually moved into assets

where the basis risk got larger and larger, until they were essentially

speculating. (Long Term Capital

Management was the best known failure in the past).