|

Lecture Notes 4, Rates & Swaps (Ch 6, 7) and Mechanics of Option Markets (Ch 8) K Foster, CCNY, Spring 2010 |

|

|

Learning Outcomes (from CFA exam)

Students will be able to:

§ define European option, American option, and the concept of moneyness of an option;

§ differentiate between exchange-traded options and over-the-counter options;

§ identify the types of options in terms of the underlying instruments;

§ compare and contrast interest rate options with forward rate agreements (FRAs);

§ define interest rate caps, floors, and collars;

§ compute and interpret option payoffs, and explain how interest rate option payoffs differ from the payoffs of other types of options;

§ define intrinsic value and time value and explain their relationship;

From

Interest Rate Futures

Day Count Conventions: Ugh, crazy details! Interest is only credited at some low frequency (every 6 months, for example) but it accrues continuously and is calculated as a fraction of the period. But what fraction? Some contracts use the actual number of days between dates divided by the days in the reference period; some use 30/360; some use actual/360. US Treasuries use actual/actual but corporate and municipal bonds use 30/360 and money market instruments (such as T bills) use actual/360.

So Hull's example that, on Feb. 28, holding a corporate bond overnight would get 3 days of interest accrual (under 30/360 rule) while holding a US government bond overnight would get just one day of interest accrual. It's just a reminder that the financial "system" is not really a "system" in the sense of something that was designed, or is even coherent. Rather it's a series of sometimes-random choices and institutions that have evolved many different ways of interacting with each other.

Treasury bond prices: dollars and 32nds of a dollar for a bond with face value of 100.

Quote "clean price" which is not the cash delivery price, the "dirty price" = clean price + accrued interest since last coupon.

Treasury bond Futures

Short party deliver any bond with maturity over 15 years and not callable within 15 years. Conversion factors (created by CBOT at benchmark 6%) defines the price. Which bonds are cheapest to deliver? Depends on yield curve and current interest rates.

Futures price: F0

= (S0 I)erT. Where "I" is PV of coupons over

life of contract.

Eurodollar futures are most common for interest earned on $1m traded on CME for any 3-month interval in next

10 years! Contracts designed so each bp

move is 1,000,000 * (1/10000) * (3/12) = 25.

Eurodollar futures can be

used to extend the LIBOR zero rates past 12 months to 2 5 years.

For short contracts, Eurodollar futures are equivalent to FRA but at longer terms the settlement periods matter (so convexity adjustment). FRAs don’t settle daily; ED futures do. Tend to decrease forward rate relative to future.

Duration hedging & duration matching uses futures contracts

Swaps

"plain vanilla" swap on LIBOR, fixed for floating, BFIX = BFL.

can transform either asset or liability fixed/float

notional principal is not exchanged; only the cash flows (So measurement of transactions is complicated)

the tenor is the frequency of payment (6 months, 3 months, 1 month, etc)

swaps can transform assets or liabilities

Confirmations are the legal agreements underlying

Also currency-based swaps to borrow/lend at different rates and currencies, different rates (plus/minus bp) amortizing or step-up swaps, constant maturity swap, equity swaps, options, swaptions (options on swaps), commodity swaps, etc., etc., etc. Exotic instruments.

Credit Risk remains and is held by the intermediary

Why Swaps? Comparative Advantage low-rated companies who would get a high fixed rate can instead borrow at floating rate, betting that they can do better than their rating agency believes.

Longer horizon LIBOR rates only to 12 months but swaps go

even farther than Eurodollar futures

Valuation of Swap: originally zero, then either as bonds or as FRA portfolio

bonds: VSWAP = BFIX - BFL.

FRA: zero curve to get forward rates, then calculate the swap cashflows, then discount using the same zero curve.

From

Mechanics of Option Trading

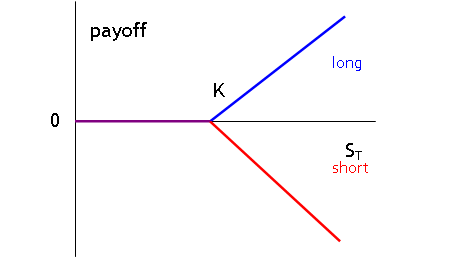

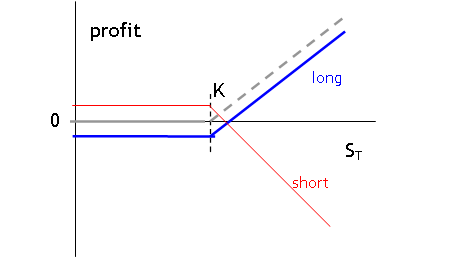

Again recall difference between option payoff and option profit (profit is net of cost of option).

Payoff to long European

call option is max(ST K, 0), where ST is the value of the

asset on expiration date.

Note "profit" is different since call has a cost:

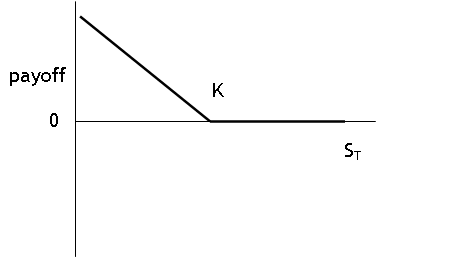

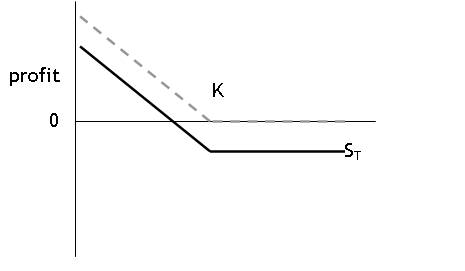

Payoff to long European put

option is max(K ST, 0).

Note that payoff to put is bounded.

Again profit is different since put also has a cost,

Payoffs to short positions are the negative.

The intrinsic value of an option is its value if it were exercised

today, either max(St K, 0) for a call or max(K

St, 0) for a put.

Underlying asset can be an individual stock, stock index, foreign currency, futures, etc.

Maturity/Expiration: Jan, Feb, or Mar schedule throughout the year; Saturday following third Friday of month

Strike prices usually spaced 2.5, 5, 10 apart but stock splits can produce nonstandard spacing

Unusually large dividends can also lead to changes in the options (decided by the exchange that regulates)

Typically option is on a "lot" of 100 shares of stock

Retail investors typically cannot buy options on margin since options are already highly leveraged instruments. Unless more than 9 months in future, then 25% margin. To write options, must maintain margin to satisfy that position will be paid.

Naked option is not hedged with position in underlying asset. Covered options have the asset to be delivered.

Other financial assets such as warrants or convertible bonds include options (usually a call option) with the bonds.

see reading - What do all of the letters in option price symbols mean.pdf