|

Lecture

Notes 8, Black-Scholes-Merton Option Valuation – 3

separate explanations! K Foster,

CCNY, Spring 2010 |

|

|

Learning Outcomes (from CFA exam)

Students

will be able to:

§ explain the assumptions underlying the Black–Scholes–Merton model and their limitations;

§ use the Black-Scholes-Merton model to

calculate options prices;

From

The Black-Scholes-Merton formula is one of the highlights of finance

theory. Mark Rubinstein, past president

of the American Finance Association, described it as, "one of the most

successful in the social sciences and has perhaps … the most widely used

formula, with embedded probabilities, in human history" (Journal of Finance, 49(3), p. 772). Nonetheless, it can be frustrating to learn

it, since the key formula seems pulled out of thin air to solve a differential

equation. You can read the original

articles (from JStor in the library):

Black, Fischer, and Myron Scholes, (1973).

"The Pricing of Options and Corporate Liabilities," The Journal of Political Economy, 81(3),

637-54.

Merton, Robert C., (1973). "Theory of Rational Option

Pricing," The

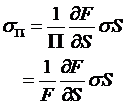

Assume that VS is Wiener process, VS = µSdt + sSdz

If this is a

model of a stock price then we want to look at how the returns vary, where the

percentage return is (S1 - S0)/S0 = ∆S/S

and from calculus, the derivative of ln(S) is dS/S or ∆S/S.

So first

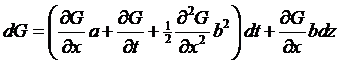

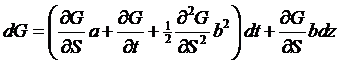

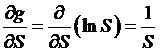

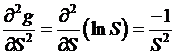

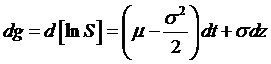

find the distribution of ln(S). By Itô's Lemma:

we have to

find the first and second derivatives of ln(S):

,

,  , and of course

, and of course  , so that:

, so that:

.

.

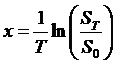

This

probably doesn't seem intuitive at all: why do we need to subtract off a term

for the volatility?

Nonetheless,

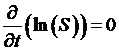

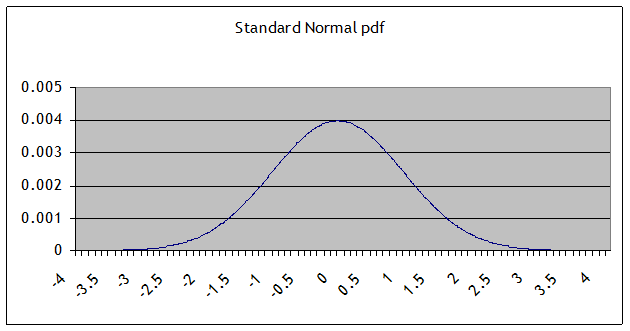

this implies that ln(S) has a normal distribution,

which can also be stated as S has a log-normal distribution. If a normal distribution looks like this:

a log-normal

distribution looks like this:

since exp(0)

= 1, the median is still at 1 however the mean is skewed to the right. This might seem like a better model for stock

changes: a stock price can never be negative (this defines the limited

liability corporation) but the upside gains can be huge (although with a very

tiny probability).

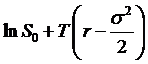

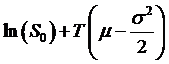

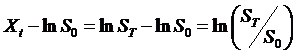

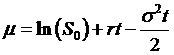

So Itô's Lemma tells us that the distribution of ln(ST) is going to be normal with mean  and standard deviation

and standard deviation

![]() . Alternately we could

express this by noting that ln(ST) – ln(S0) = ln(ST/S0)

has mean

. Alternately we could

express this by noting that ln(ST) – ln(S0) = ln(ST/S0)

has mean  and the same standard

deviation.

and the same standard

deviation.

Now we want

to figure the distribution of x, where x is the return on a stock over a period

of time,

. This is just

dividing through by a constant (T) so the new mean is going to be

. This is just

dividing through by a constant (T) so the new mean is going to be  and the standard

deviation will be

and the standard

deviation will be ![]() .

.

Assumptions of Black-Scholes-Merton model:

- Stock has log-normal

distribution

- Short-selling is permitted

without restrictions

- No transactions costs or taxes

- No riskless arbitrage

opportunities

- Continuous trading of securities

- Riskfree interest rate, r, is constant

for all maturities

Some of

these assumptions will be later relaxed but we'll keep them for now.

Black-Scholes

formulas:

Modify the

intrinsic value formulas (and recall the lower bound formulas) to get something

that looks like the expected present value analogs:

call payoff:

![]()

Remember we

found that it has a lower bound of S0 – Ke-rT,

which in some sense is the present-value analog of its intrinsic value.

From

what we learned about risk-neutral valuation, we might think of taking some

sort of risk-neutral expectation of the call value to find its price; this

might mean finding some probabilities, π1 and π2,

such that

π1S0

- π2Ke-rt

gives the price of

the call. This is an excellent

guess! Figuring out the exact functions

for these probabilities is a bit tricky, but that's what BSM got a Nobel prize

for. The formula just fills in Normal

calls for those probabilities.

call price: ![]()

Similarly for puts,

put payoff: ![]()

has lower bound of Ke-rT - S0 so the BSM formula fills

in probabilities, π3 and π4, in the formula,

π3Ke-rt - π4S0 to get

![]() put price:

put price: ![]() ,

,

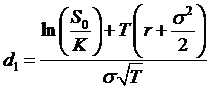

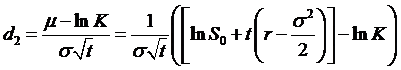

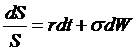

The d1

and d2 parameters can be seen as measuring the location of the

strike price relative to the expected value of the stock. They are the standardized measure of how many

standard deviations from the mean is the value,  . These probabilities

discount the intrinsic value terms for the call and put.

. These probabilities

discount the intrinsic value terms for the call and put.

We are given

a present stock price and a strike price, and we want to figure out how far

away the strike price is, from the likely future value of the stock. How far is far? A few pennies might not be much if the stock

trades at $75 per share but for "penny stocks" it could be a very

long way. It is the volatility that

gives the answer. So we want to take the

distance between S0 and K (actually the natural log of the distance,

since we're assuming a distribution of returns), {lnS0 – lnK}, subtract the mean (this is the  term), and divide by

the standard deviation.

term), and divide by

the standard deviation.

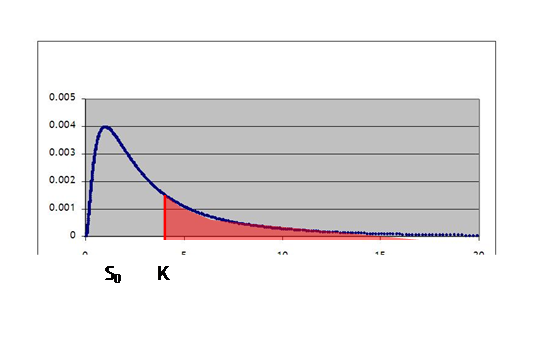

Consider the

problem graphically from the standpoint of risk-neutral valuation. We have S0 and K, where we assume

that ST is distributed log-normal.

So if we were valuing an out-of-the-money call, we might have something

like this:

Where the

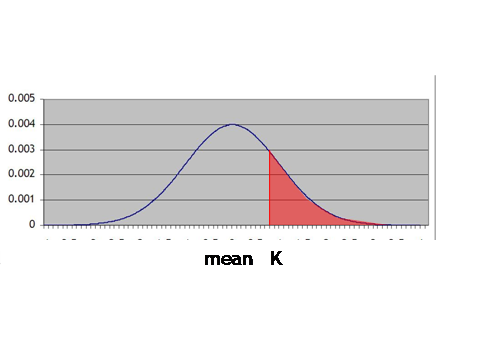

red shaded area is where the call would pay off. The first step is to translate this

log-normal distribution into a standard normal, which is done by transforming

the mean and variance, so that we get something like:

Then we want

to find the expected value of a payoff that starts at zero at K and rises above

that level.

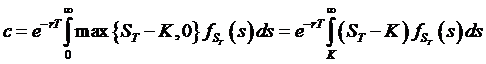

This call

option has value max(ST – K, 0) so its present discounted expected

value is e-rTE[max(ST

– K, 0)], which is ![]() . The reason for the

separate terms d1 and d2 is that they relate to different

expected values: a call option entitles the bearer to get ST if ST>K

but costs K (but no more) if ST>K. If we rewrite the Black-Scholes

formula,

. The reason for the

separate terms d1 and d2 is that they relate to different

expected values: a call option entitles the bearer to get ST if ST>K

but costs K (but no more) if ST>K. If we rewrite the Black-Scholes

formula, ![]() , then the second term is the probability that the stock will

get as high as the strike price, K. The

first term is the probability that the call will return the stock price (i.e.

that it will be above the strike) – and will be zero if not.

, then the second term is the probability that the stock will

get as high as the strike price, K. The

first term is the probability that the call will return the stock price (i.e.

that it will be above the strike) – and will be zero if not.

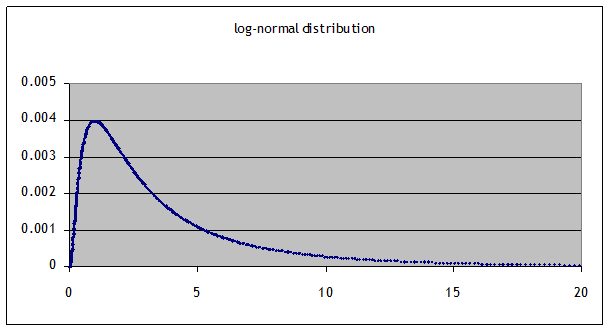

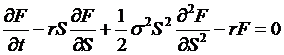

The Black-Scholes formula is a solution to the Black-Scholes differential equation (which is a form of the heat

equation). Return to the "delta

hedging" argument. We could buy V shares of stock to form a perfect

hedge against the movements of an option.

(Actually it is only a perfect hedge for infinitesimal changes, but for

now we'll elide that problem.) What is

delta? If we label the option price as p

(some price) we of course note that p is a function of the stock value and

time, so we can write p(S,t). So if the stock price changes by VS then the option price will change

by  , so if

, so if  then we have a perfect

hedge. So the position is (VS – p) , or, dividing through by V, (S – p/V).

Since this is a riskless portfolio, it should return rVt (or else there are arbitrage

opportunities). As there are tiny

changes, the value is (dS – dp/V), but we need some stochastic

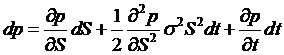

calculus (Itô's Lemma) to get a value of dp. Recall that

then we have a perfect

hedge. So the position is (VS – p) , or, dividing through by V, (S – p/V).

Since this is a riskless portfolio, it should return rVt (or else there are arbitrage

opportunities). As there are tiny

changes, the value is (dS – dp/V), but we need some stochastic

calculus (Itô's Lemma) to get a value of dp. Recall that

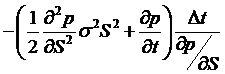

so, substituting back,

so, substituting back,

. Set this equal to

the riskfree rate and get

. Set this equal to

the riskfree rate and get

. There is one

boundary condition, which is the definition of the option, that p(x,T) = payoff (at date T, the expiration date). The solution to this partial differential

equation is the Black-Scholes equation.

. There is one

boundary condition, which is the definition of the option, that p(x,T) = payoff (at date T, the expiration date). The solution to this partial differential

equation is the Black-Scholes equation.

A bit more intuition:

We can check

if the formula results change as we would intuitively expect, given the

different input arguments.

call price: ![]()

put price: ![]() ,

,

where  and

and  or

or ![]() .

.

The stock

return does not explicitly appear in the formula, except insofar as it affects

the current price. The time-to-maturity

for the option appears only multiplied by the risk-free interest rate and the

volatility, so these aspects are intuitive enough. As time-to-maturity, volatility, or the

risk-free rate increase (T, s, or r), the value of the option rises towards its

intrinsic value.

As

volatility falls toward zero, then if the option is already in the money then

the probability that it will stay there goes towards 1 and the option is worth

the intrinsic value. If the option were

out of the money, then a low volatility means it is less and less likely to

ever be worth more than zero.

As the stock

price rises (S0), it becomes almost certain that the option will be

exercised and the call price rises toward S0 – e-rTK, as

d1 and d2 rise so that cdfN( ) of each of

those gets closer and closer to 1. A put

price would go in the other direction as the stock price rose; again -d1

and -d2 would drive the cdfN( )

terms toward zero.

See the

Excel sheet showing how changes in the parameters affect call and put

prices. (These are "the

Greeks" – but we'll get to that later.)

Implied Volatilities

In practice,

some of the crucial Black-Scholes assumptions are not

true so the formulas are not exact.

However they are nonetheless often used in reverse to generate a

volatility from a given option price. If

an at-the-money call price is $6.46, is that a good or a bad price? It depends on the current price of the stock,

in a nonlinear way. A different way to

price an option is to quote its implied volatility – i.e. that volatility

which, put into the Black-Scholes equation, would

give the price that is "really" being quoted. This may allow a market participant to better

judge whether the price is good or bad by instead asking, is the volatility

reasonable? If the implied volatility is

too high then the price is high; if the implied volatility is low then the

price is low. Note that this is done,

even though everyone knows that the Black-Scholes

model is not the "true" description of option prices! It still provides a handy way of translating

prices.

Of course,

figuring out these volatilities is no small task, since there is no simple

formula. It takes a computer search

program to do it – to guess numbers and then work to improve the guess until it

is within some criterion range.

Relation to Binomial Trees

Finally note

that we would get the same answer by taking a binomial tree model over a fixed

time period but taking more and more ever-smaller steps.

|

Another take on Black-Scholes-Merton |

|

|

The basic

Black-Scholes formula is pretty simple, once we get

used to it. The expected payoff to a

call (for example) at time T is max{ST – K,0}. If the call is not exercised its value is

zero so it only has value if exercised, so the future payoff is STcdfN(d1) - KcdfN (d2), where d1 and d2

indicate the probabilities that the option will be exercised. We know that a risk-neutral no-arbitrage

valuation implies that ST = S0ert so we

replace that to get S0ertcdfN (d1)

- KcdfN (d2), which is the

future value. The present value

multiplies by e-rt to get S0cdfN

(d1) - Ke-rt cdfN (d2).

Remember our

basic argument: given some stock return that follows a Wiener process, dS = µSdt + sSdz, we want to find the distribution of

the function, g(S) = ln(S). Itô's Lemma tells

us that

,

,

so we figure

that  ,

,  ,

,  , a = µS, and b = sS, that

, a = µS, and b = sS, that  . Since d[lnS] is a Wiener process, we can assert that lnST has a Normal distribution with mean, under

a risk-neutral measure, of

. Since d[lnS] is a Wiener process, we can assert that lnST has a Normal distribution with mean, under

a risk-neutral measure, of

Where did

that ![]() come from? That's the mystery of stochastic calculus.

But there is another way.

come from? That's the mystery of stochastic calculus.

But there is another way.

Jay

Jorgenson and Adriana Espinosa (here at CCNY) have figured out another way to

derive the Black-Scholes-Merton formula, without Itô's Lemma, just some algebra. This summarizes their paper, Espinosa and

Jorgenson (2003).

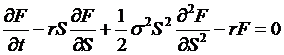

We assume

that a stock's return is given by:

![]()

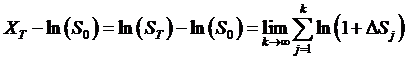

Next define ![]() and thus

and thus

![]() ,

,

![]() ,

,

![]()

So that ![]() , which allows us to interpret the

, which allows us to interpret the  as the percent return;

also note that

as the percent return;

also note that ![]() .

.

We assume

that the ΔS are independent and identically distributed. Independent means that the ΔS at time t

does not depend on the previous day's (or week's or month's) ΔS; the

assumption of identical distribution allows us to assert that its variance is

constant over time. The independence is

a consequence of weak market efficiency, since if the change in stock price

could have been predicted then why wasn't it arbitraged away?

Remember,

from stats, the basic relation that if A and B are independent then the var(A+B) = var(A) + var(B). Now from the

definition of Xt as a sum of independent

but identically distributed terms, we can see that, for any number of little

steps up to time t, the variance of Xt is

![]() ,

,

where, since

theΔS are identical, the variance of ΔS1

is the same as ΔST or any other ΔS – and we'll define this

variance as some constant, s2.

Why all of

this work? Because we might remember the

Central Limit Theorem (CLT) from statistics.

This states that a sum of independent and identically distributed terms

can converge to a distribution, as the number of steps goes higher and

higher. (I use the term "can"

not "must" to remind us that there are a few technical details to be

taken care of, before this is an actual proof, but for now we'll ignore

those.) The Central Limit Theorem allows

us to assert that the distribution goes towards a Normal distribution. The Central Limit Theorem implies:

converges to

a normal distribution with some mean and standard deviation. We have seen that the variance of lnSt must be s2t so that the standard deviation is ![]() , but what is the mean?

, but what is the mean?

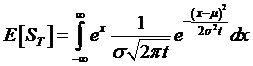

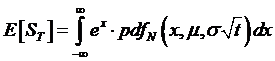

To figure

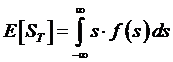

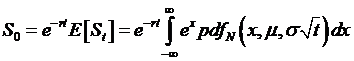

out the mean of this variable, we take a detour through risk-neutral no-arbitrage

pricing. Remember that this argument

contends that

S0 = e-rt E[St],

where the E[

] expected value function uses the probability density function f( ) and is

defined as

.

.

This doesn't

seem to help since we don't know the distribution function of S so we don't

know the probability density function, f( ).

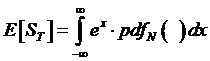

But the Central Limit Theorem tells us that XT = lnST has a normal distribution, so we would like

to use X instead of S and then integrate with respect to the normal probability

density function rather than some unknown pdf. So we switch the variables X and S by

inserting eX for S (since, by definition, ![]() ), and put in a normal probability distribution,

), and put in a normal probability distribution, ![]() instead of

instead of ![]() to write

to write

.

.

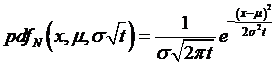

But the

normal probability density function depends on the mean, µ, and standard

deviation, s, so we can write the normal

distribution function as ![]() . We figured out that

the standard deviation is

. We figured out that

the standard deviation is ![]() but what about µ? For now we'll leave it as a variable, and

write:

but what about µ? For now we'll leave it as a variable, and

write:

, where the function,

, where the function, ![]() , is defined as

, is defined as

so that

so that

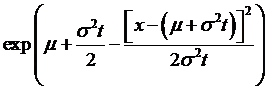

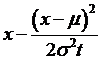

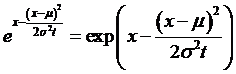

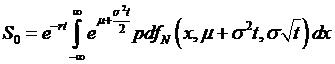

We have an

awful lot of terms with e to some

power – can we fix that? Let's

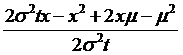

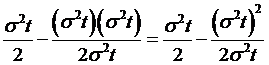

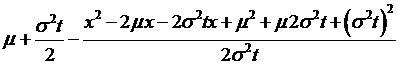

concentrate on the integrand; we see that we are integrating

![]() . We can transform the

exponent as follows:

. We can transform the

exponent as follows:

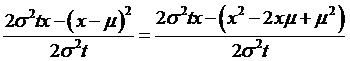

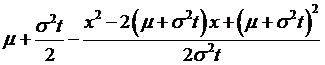

=

=

=

=

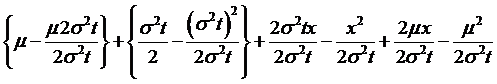

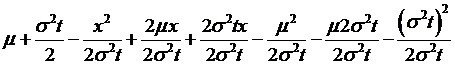

Now what if

we did the ancient mathematician's trick of adding and subtracting a number –

which doesn't change the equality but can transform the variables? So add-and-subtract these terms,

and another  , to get

, to get

=

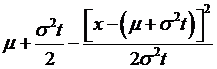

=

=

=

=

So that we

can re-write  as

as

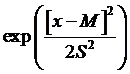

Why the heck

is that any better? Recall that the

formula for a normal distribution involves  , where M is the mean and S is the standard deviation. The last part of the exp( ) function above

looks like a normal, if we had

, where M is the mean and S is the standard deviation. The last part of the exp( ) function above

looks like a normal, if we had ![]() and

and ![]() .

.

So going

back up to the equation, which had the risk-neutral no-arbitrage value of  , we replace the integrand with the value found after all of

the algebra to get:

, we replace the integrand with the value found after all of

the algebra to get:

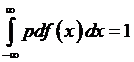

This allows

us to take the ex term that we were integrating out from under the

integral, where it was a pain to deal with.

Now that it's e to the power

of some constant ( ), we can take it to the outside of the integral. Once that's outside the integral, then all

that's left inside is the pdf of a probability

function, and we know that

), we can take it to the outside of the integral. Once that's outside the integral, then all

that's left inside is the pdf of a probability

function, and we know that  so that we get

so that we get

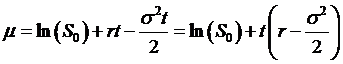

That's a lot

easier, isn't it?! Then we can take logs

and solve to find that

This is what

Ito's Lemma gave (way back in the beginning), but without the stochastic

calculus. Granted, there's a lot of

algebra instead, but that's more tedious than mystery.

So to price

an option, we just use the expected value formula from above, with the proper

distribution function. A risk-neutral

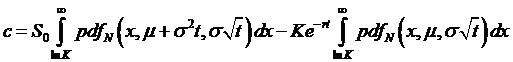

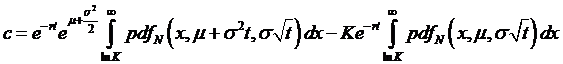

no-arbitrage argument tells us that a call price, c, must be:

.

.

Note that

we've eliminated the "max( )" function by just changing the bounds of

integration – this is the conditional expectation now, the expectation of (ST

– K), conditional on if the stock is greater than K.

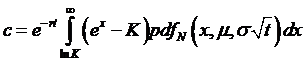

If we make a

change of variables so that X = ln(S) (thus, S=ex),

then we can switch the probability function from involving ST to

involving ex, which has a distribution that we understand – that's

got mean µ (remember that  and standard deviation

and standard deviation ![]() . As part of this

change of variables, we also must change the boundary of integration, now to ln(K). So we get:

. As part of this

change of variables, we also must change the boundary of integration, now to ln(K). So we get:

.

.

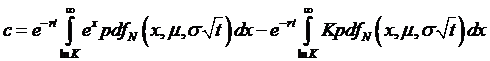

So now we

break up the pieces and get an integral of ex (which is a problem

that we solved before – we've just got to fix the bound of integration) and an

integral of K, which is a constant and so easy.

So

, which is

, which is

,

,

and where

the equation with all of the algebra allows us to rewrite the first term to get

(note that

now the first and second pdf's are different – one

has a transformed mean from the ex simplification and the other does

not). But both pdf's

are pretty simple: they're just integrating over a part of the curve, which is

finding the cumulative distribution, cdfN(

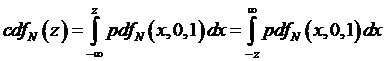

), for some values. So by definition

.

.

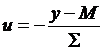

For a

variable, y, that doesn't have a standard normal distribution (mean zero and

standard error of one), we define  , where M is the mean and

, where M is the mean and ![]() is the standard error,

to change variables so that

is the standard error,

to change variables so that

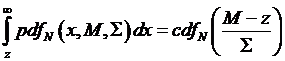

.

.

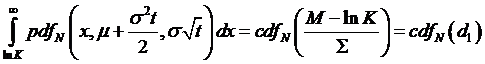

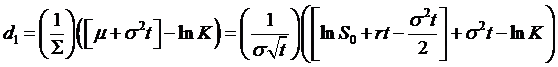

So going

back to the equation for the call price, we evaluate the piece,

,

,

where the

term d1 (chosen for no special significance, just by coincidence it

might seem like it could be like the Black-Scholes

formula term d1!) is

(the last

substitution for µ is from the earlier equation ). This simplifies to

-- which should look

familiar.

-- which should look

familiar.

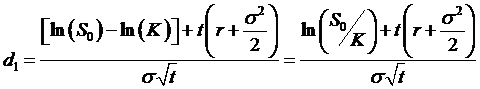

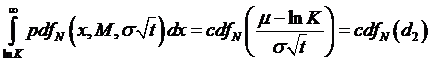

Again going

back to the equation for the call price, we next evaluate the piece,

,

,

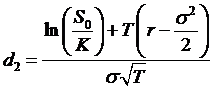

where now d2

just happens to be

,

,

which again

looks familiar.

So the call

price, c is given as

![]() ,

,

which ought

to look real familiar – it's the Black-Scholes-Merton

formula!

|

Yet another take on Black-Scholes-Merton |

|

|

from Björk

This basic

method of finding the BSM model remains fundamentally similar to how we solved

the tree models: show that there is some combination of stock and derivative

that makes a riskless portfolio, so then this portfolio must return the risk-free

rate, so we can value the initial derivative position.

As usual in

solving differential equations, this means pushing around our equation until we

get it into a form that has already been solved by smart people; in this case

this is the Feynman-Kac equation.

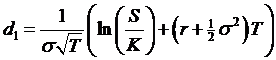

Again assume

that there is free and costless trading of any position in the derivative,

stock, and riskless bond.

The

derivative price process changes over time; we label this ![]() since it depends

directly on time and the stock value. As

usual St is the stock price, Bt is the bond price that returns a riskless rate

of return, r, the derivative matures at T, and we model the stock process as

since it depends

directly on time and the stock value. As

usual St is the stock price, Bt is the bond price that returns a riskless rate

of return, r, the derivative matures at T, and we model the stock process as

![]() ,

,

where dW is the driving Wiener process.

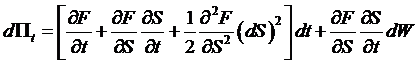

Taking the derivative

price as ![]() , we use Itô's Lemma to find the

total differential,

, we use Itô's Lemma to find the

total differential,

.

.

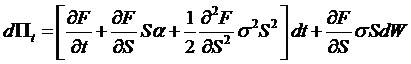

Then

substitute that  ,

, ![]() , and

, and  , so

, so

.

.

Rewrite this

into

![]() ,

,

where  and

and  .

.

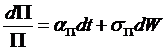

So now we

have

the bond price process,

the stock price process,  ,

,

and the derivative price

process,  .

.

Next we want

to find some combination of stock and derivative positions that will make a

riskless self-financing portfolio, V.

This means dividing the fraction of the portfolio invested in the stock,

u, and of the fraction invested in the derivative, (1 – u), such that ![]() .

.

Recall that,

from our most basic classes, we understand how to find the growth rate for some

composite based on the growth rates of the parts: if my portfolio is invested ¼

in small-cap stocks and ¾ in large-cap stocks, then the growth of my portfolio

is ¼(growth of small-cap) + ¾(growth of large-cap).

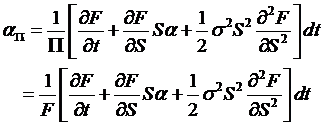

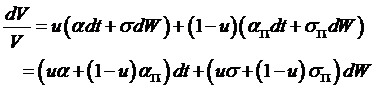

So we can

write  and substitute from

above to write:

and substitute from

above to write:

Now this

portfolio will be riskless if we choose the share invested into stock, u,

correctly so as to zero out the dW term; so choose u

such that ![]() , or

, or  . This is defined as

long as

. This is defined as

long as ![]() , which would only happen if

, which would only happen if  , if the price of the derivative were unrelated to the stock

price – which would be very odd indeed!

So this makes

, if the price of the derivative were unrelated to the stock

price – which would be very odd indeed!

So this makes

.

.

So if the

value of the portfolio has no random element, then it must grow at the riskless

rate, so  and

and ![]() .

.

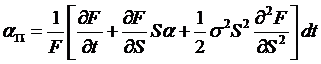

Now

substitute in terms,  ,

,  , and

, and  , and note especially that the

, and note especially that the  terms drop out – the

derivative price has no dependence on the stock's rate of growth. So we get the equation,

terms drop out – the

derivative price has no dependence on the stock's rate of growth. So we get the equation,

with the boundary

constraint that, at the expiration date T,

with the boundary

constraint that, at the expiration date T, ![]() .

.

Now for the

casual person reading along, this doesn't look like it's much help, but it

actually is helpful. This is because, as

I mentioned above, somebody else has already a solved tough equation just like

it – it's called Feynman-Kac.

|

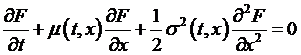

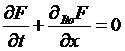

Sidebar: The

Feynman-Kac solution sets up the problem from a

differential equation like this: The

equation might look like a hopeless mess unless we were to remember our Itô calculus and decide that the second part looks like a

part of the derivative when we have to include second-order terms, so we

could write the differential equation as Then

the Feynman-Kac result shows that the solution for

the function, F, that solves this problem is: where

X satisfies It

is a straightforward extension to show that if we had some These

actually allow a much more generalized Itô process

than in the original Black-Scholes-Merton, since

these allow the mean process |

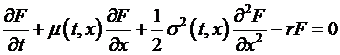

To return to

the original Black-Scholes-Merton problem, we have

the equation

with the boundary

constraint that, at the expiration date T,

with the boundary

constraint that, at the expiration date T, ![]() . Hooray! This is exactly the formula that the Feynmac-Kac result solves for us, so we don't have to do

extra hard work, they've already done it for us! (Positive externalities of knowledge

capital.)

. Hooray! This is exactly the formula that the Feynmac-Kac result solves for us, so we don't have to do

extra hard work, they've already done it for us! (Positive externalities of knowledge

capital.)

In the

simple case where the mean and variation processes are constants, then we can

write the solution from  to get the Black-Scholes-Merton formula, that for a call,

to get the Black-Scholes-Merton formula, that for a call,

![]() ,

,

where  and

and ![]() and

and ![]() is the standard normal

cumulative distribution function.

is the standard normal

cumulative distribution function.